June 04, 2025 a 04:44 pm

CAT: Fibonacci Analysis - Caterpillar Inc.

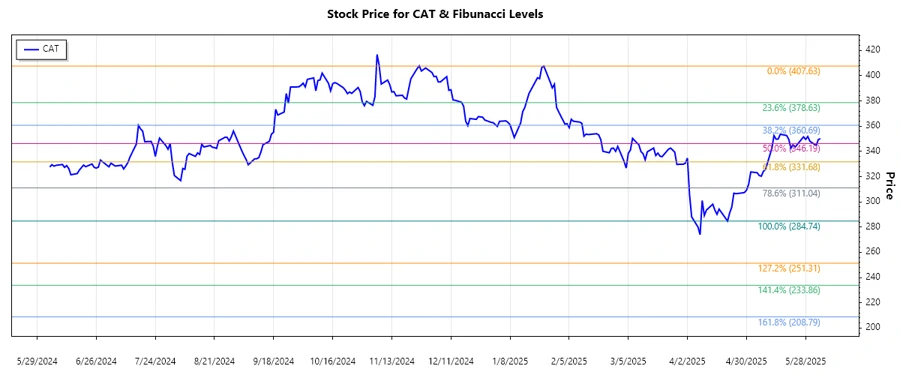

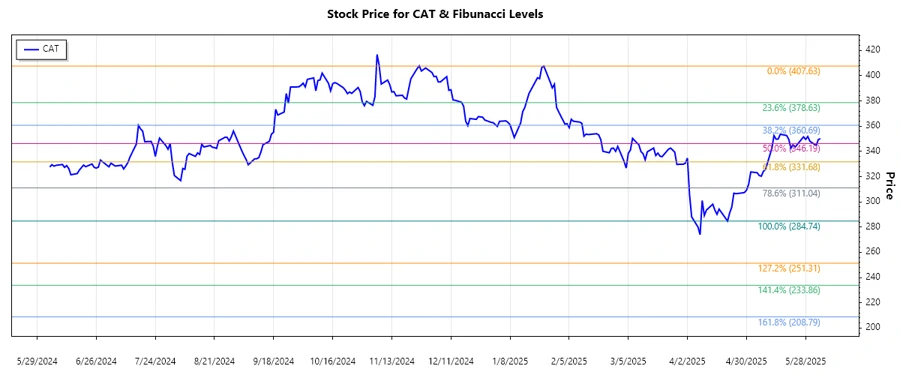

Caterpillar Inc., a leader in the industrial sector, has shown robust price movement in recent months. The company's diverse portfolio, spanning construction, mining, and energy solutions, contributes to its strong growth potential. While the latest trend for CAT shows a significant decline, investors might find opportunities in strategic retracement levels. Understanding the technical indicators and market demand can guide decisions, especially watching for potential support levels.

Fibonacci Analysis

| Trend Detail | Value |

|---|---|

| Start Date | 2025-01-24 |

| End Date | 2025-06-04 |

| High Point (Price/Date) | $407.63 on 2024-11-06 |

| Low Point (Price/Date) | $284.74 on 2025-04-21 |

| Fibonacci Level | Price Level |

| 0.236 | $325.07 |

| 0.382 | $349.09 |

| 0.5 | $373.19 |

| 0.618 | $397.29 |

| 0.786 | $421.90 |

| Current Price | $350.07 |

| Retracement Zone | 0.382 |

| Interpretation | The current price is within the 0.382 retracement zone, suggesting potential support. |

Conclusion

Caterpillar Inc.'s stock is currently navigating through a period of retracement after a significant downtrend, resting near the 0.382 Fibonacci level. This zone might act as a potential support level, with indications of market stabilization. Investors should watch for opportunities around these retracement levels and look for signs of reversal or further support. With Caterpillar's strong position in diversified industries, the stock offers substantial growth potential, albeit with inherent market risks. Keeping a vigilant eye on technical signals and broader economic factors will be crucial for potential investment strategies.