October 30, 2025 a 05:08 am

CADJPY: Fibonacci Analysis

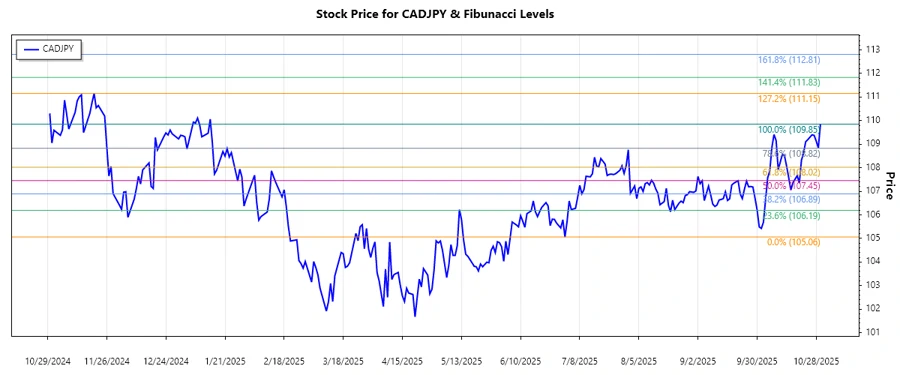

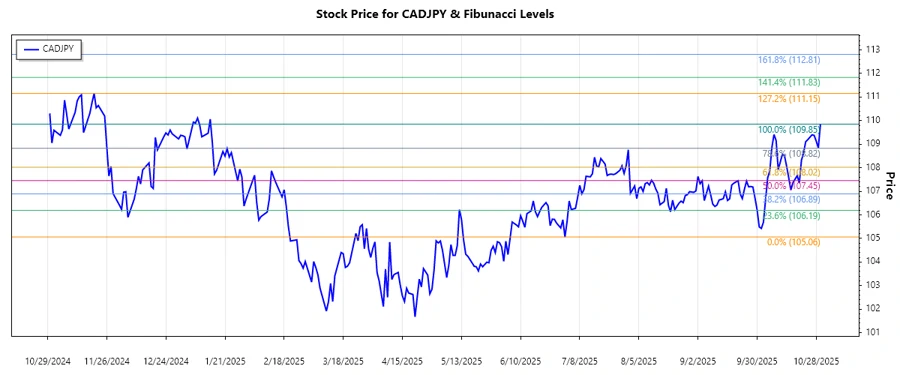

The Canadian Dollar against the Japanese Yen has seen a dynamic shift over the past few months. With Canada's economic indicators showing strength and Japan's ongoing fiscal policies, the CADJPY pair portrays significant fluctuations. Analyzing recent data, an upward trend can be observed as market sentiments lean towards CAD's favor. This has prompted a close reevaluation utilizing Fibonacci retracement levels for future price movements insights.

Fibonacci Analysis

| Trend Period | High Date | High Price | Low Date | Low Price |

|---|---|---|---|---|

| Feb 14, 2025 - Oct 30, 2025 | 2025-10-30 | 109.85 | 2025-07-01 | 105.06 |

Fibonacci Levels

| Level | Price |

|---|---|

| 0.236 | 106.91 |

| 0.382 | 107.76 |

| 0.5 | 108.21 |

| 0.618 | 108.65 |

| 0.786 | 109.18 |

The current price is analyzed to be within the 0.786 retracement zone. This suggests a potential resistance level where the currency pair might face selling pressure. Analysts should consider this as a pivotal point where bulls might find difficulty breaking through without substantial volume.

Conclusion

In conclusion, the recent upward trend in CADJPY is reinforced by strong economic fundamentals in Canada. However, the identified Fibonacci retracement levels provide crucial insights into potential resistance zones. Should the 0.786 level fail to hold, a further downside correction could be expected. Analysts must remain vigilant on the trading volume and global economic cues to gauge the pair's path forward accurately. The market remains ripe with opportunity yet warrants caution amidst global uncertainties.