July 18, 2025 a 04:28 am

CADCHF: Trend and Support & Resistance Analysis

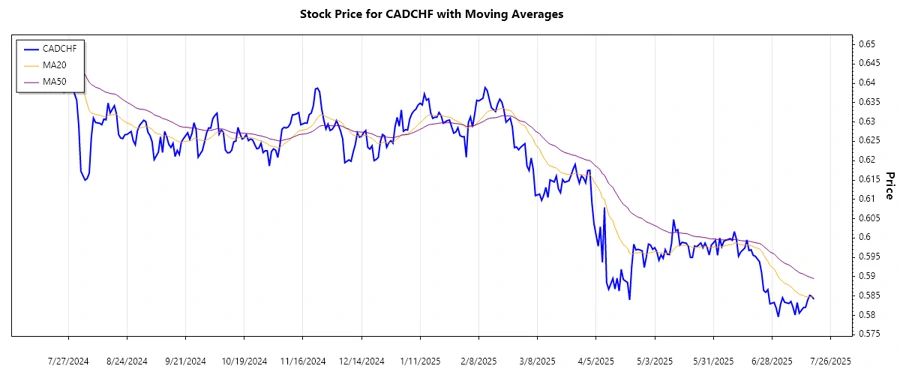

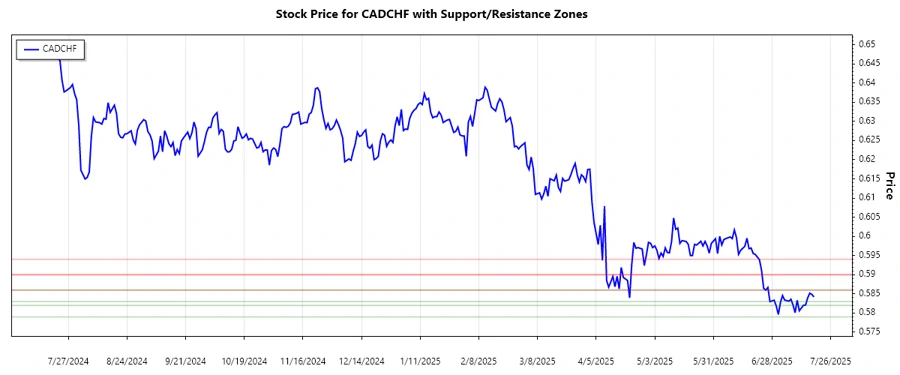

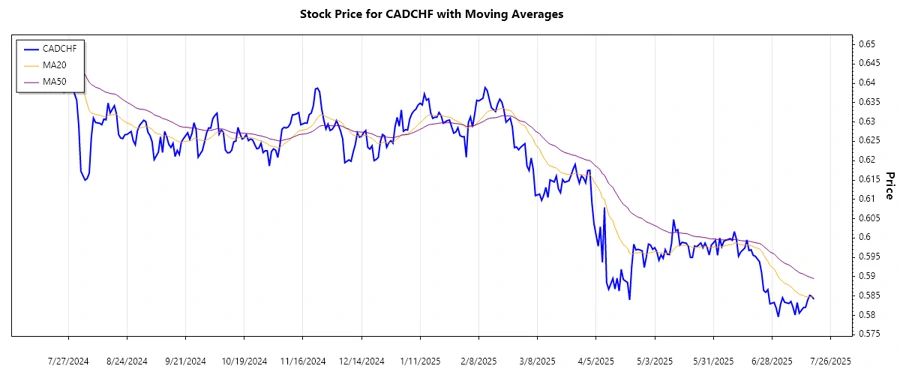

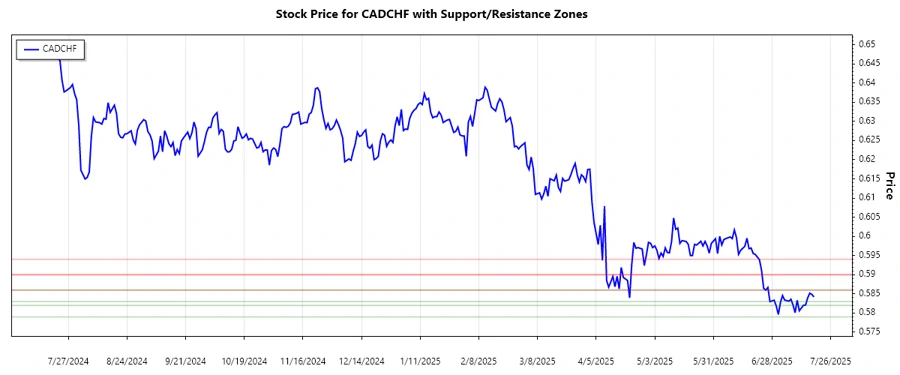

Over recent months, the CADCHF currency pair has exhibited a notable downward trend. The analysis of moving averages further corroborates the bearish sentiment. With prices finding several support zones, the market currently suggests resilience against further downward pressures. However, resistance zones pose a persistent challenge, limiting upward momentum. Traders should remain vigilant, focusing on strategic entry points within these zones.

Trend Analysis

The CADCHF has shown a consistent decline, with moving averages indicating a clear bearish trend. The EMA20 is below the EMA50, signaling downward momentum. The market has struggled to maintain any significant upward trajectory, often facing rejection at resistance levels.

| Date | Close Price | Trend |

|---|---|---|

| 2025-07-18 | 0.5842 | ▼ |

| 2025-07-17 | 0.58486 | ▼ |

| 2025-07-16 | 0.58518 | ▼ |

| 2025-07-15 | 0.58395 | ▼ |

| 2025-07-14 | 0.58208 | ▼ |

| 2025-07-13 | 0.58203 | ▼ |

| 2025-07-11 | 0.58059 | ▼ |

The EMA calculations underscore a strong downtrend, suggesting traders remain cautious of short-term rallies.

Support and Resistance

The current market structure of CADCHF defines clear support and resistance zones. Support is identified near 0.579 and 0.583, while resistance is noted around 0.586 and 0.590. Recently, the pair has been testing support levels, indicating selling pressure.

| Zone | From | To |

|---|---|---|

| Support 1 | 0.579 | ▼ 0.582 |

| Support 2 | 0.583 | ▼ 0.586 |

| Resistance 1 | 0.586 | ▲ 0.590 |

| Resistance 2 | 0.590 | ▲ 0.594 |

Currently, the price remains within the lower support zone, suggesting more pressure to drift lower unless bullish momentum picks up.

Conclusion

The CADCHF currency pair is entangled in a pronounced downtrend, with technical indicators pointing towards sustained bearish momentum. Prices gravitate towards lower support zones, with limited breakthroughs past resistance. For traders, this may present opportunities primarily in short positions, capitalizing on downward momentum. However, the possibility of consolidations around support zones should not be disregarded, which could prompt short-term bullish corrections. Vigilant monitoring and adaptation to shifting market conditions are advised for optimal positioning.