June 26, 2025 a 12:32 pm

Bonds - Performance Analysis

The bond market experienced varied performances across different maturities over the past weeks. A blend of market factors influenced the trends observed, with longer-term bonds generally outperforming their shorter-term counterparts over the one-month period. For longer-term assessments, volatility has presented both opportunities and risks for investors.

Bonds Performance One Week 📊

Over the past week, bonds with longer maturities have marginally outperformed shorter-term securities. The "20+ Year Treasury Bond ETF" led the pack, reflecting investor sentiment leaning towards long-term yields. Short-term instruments meanwhile exhibited stable yet modest growth.

| Bond | Performance (%) | Performance |

|---|---|---|

| 20+ Year Treasury Bond ETF | 1.00 | |

| 10-20 Year Treasury Bond ETF | 0.95 | |

| 7-10 Year Treasury Bond ETF | 0.80 | |

| High Yield Corporate Bond ETF | 0.76 | |

| 3-7 Year Treasury Bond ETF | 0.64 | |

| TIPS Bond ETF | 0.43 | |

| 1-3 Year Treasury Bond ETF | 0.29 |

Bonds Performance One Month 🚀

The monthly bond analysis showed significant appreciation in longer-term treasury securities, particularly the "20+ Year Treasury Bond ETF" which topped the performance chart. This trend indicates a possible shift towards longer-duration investments amid market volatility and future rate expectations.

| Bond | Performance (%) | Performance |

|---|---|---|

| 20+ Year Treasury Bond ETF | 2.13 | |

| 10-20 Year Treasury Bond ETF | 1.95 | |

| 7-10 Year Treasury Bond ETF | 1.21 | |

| High Yield Corporate Bond ETF | 0.92 | |

| 3-7 Year Treasury Bond ETF | 0.81 | |

| TIPS Bond ETF | 0.67 | |

| 1-3 Year Treasury Bond ETF | 0.25 |

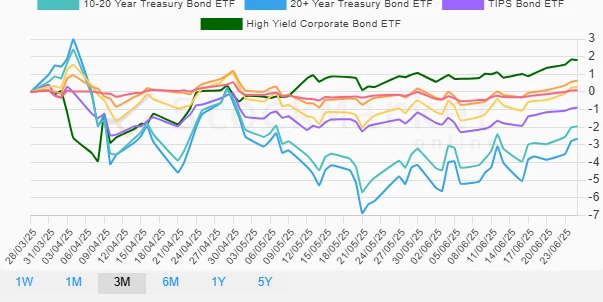

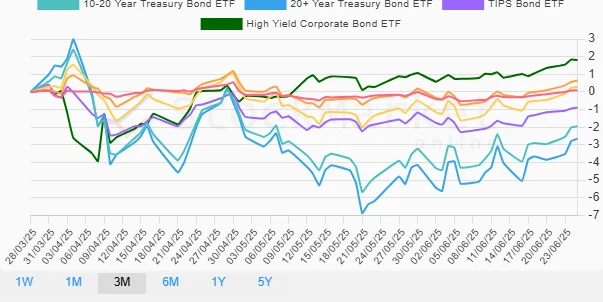

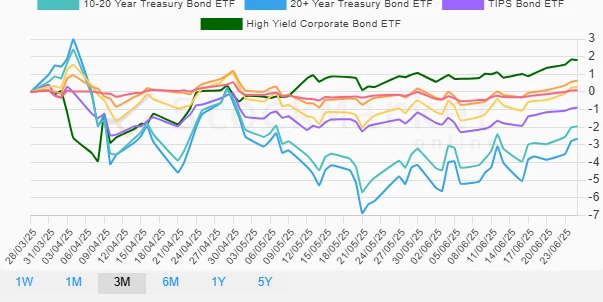

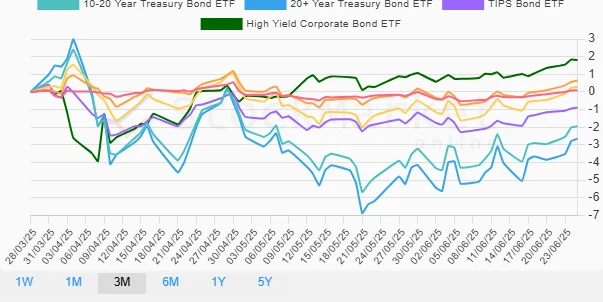

Bonds Performance Three Months 📉

Three-month analyses depict notable volatility with long-term Treasury bonds recording significant negative returns, particularly the "20+ Year Treasury Bond ETF". This suggests that recent economic policy shifts might be affecting long-term yield expectations adversely.

| Bond | Performance (%) | Performance |

|---|---|---|

| High Yield Corporate Bond ETF | 1.81 | |

| 3-7 Year Treasury Bond ETF | 0.64 | |

| 7-10 Year Treasury Bond ETF | 0.29 | |

| 1-3 Year Treasury Bond ETF | 0.09 | |

| TIPS Bond ETF | -0.89 | |

| 10-20 Year Treasury Bond ETF | -1.95 | |

| 20+ Year Treasury Bond ETF | -2.66 |

Summary & Recommendations 🗣️

The analysis across all periods shows a clear preference for high-yield corporate bonds in uncertain markets, given their relatively strong performance. Conversely, long-term Treasuries have faced headwinds, especially over the three-month period, indicating adverse reactions to anticipated macroeconomic shifts. It is advisable for investors to remain vigilant, diversify across short to medium durations, and stay informed of macroeconomic trends potentially impacting long-term yields.