October 02, 2025 a 12:32 pm

Bonds - Performance Analysis

📊 The bond market has shown varied performance across different timeframes, influenced by interest rate shifts and macroeconomic conditions. Short-term bonds reflect minor changes, while long-term bonds demonstrate more volatility due to interest rate sensitivity. High Yield and TIPS ETFs indicate investors' risk appetite and inflation expectations.

Bonds Performance One Week

💡 This week's bond performance highlights significant movement in longer-duration instruments, with the 20+ Year Treasury Bond ETF emerging as the top performer. Conversely, the 1-3 Year Treasury Bond ETF experienced a minor decline, reflecting its lower sensitivity to interest rate changes.

| Bond | Performance (%) | Performance |

|---|---|---|

| 20+ Year Treasury Bond ETF | 0.35 | |

| 10-20 Year Treasury Bond ETF | 0.31 | |

| 7-10 Year Treasury Bond ETF | 0.23 | |

| 3-7 Year Treasury Bond ETF | 0.15 | |

| High Yield Corporate Bond ETF | 0.05 | |

| TIPS Bond ETF | 0.12 | |

| 1-3 Year Treasury Bond ETF | -0.04 |

Bonds Performance One Month

🔍 In the one-month analysis, the long-duration 20+ Year Treasury Bond ETF led the performance, reflecting shifts in macroeconomic expectations and investor sentiment towards longer-term instruments. Notably, TIPS and High Yield Bonds are catching investor interest due to inflation hedging and higher yield prospects.

| Bond | Performance (%) | Performance |

|---|---|---|

| 20+ Year Treasury Bond ETF | 4.23 | |

| 10-20 Year Treasury Bond ETF | 3.03 | |

| 7-10 Year Treasury Bond ETF | 0.97 | |

| High Yield Corporate Bond ETF | 0.70 | |

| TIPS Bond ETF | 0.62 | |

| 3-7 Year Treasury Bond ETF | 0.31 | |

| 1-3 Year Treasury Bond ETF | 0.16 |

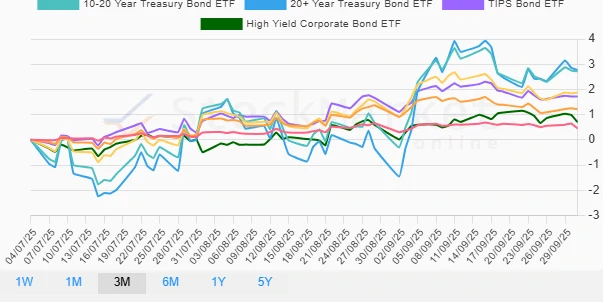

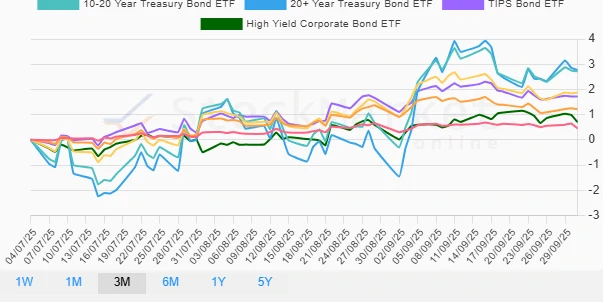

Bonds Performance Three Months

📈 The three-month perspective showcases consistent but moderate gains in most bond categories, with the 20+ Year Treasury Bond ETF again leading, suggesting sustained investor interest in duration play. Shorter-duration bonds exhibited smaller yet positive performance, indicative of cautious investment behavior amid market volatility.

| Bond | Performance (%) | Performance |

|---|---|---|

| 20+ Year Treasury Bond ETF | 2.77 | |

| 10-20 Year Treasury Bond ETF | 2.72 | |

| 7-10 Year Treasury Bond ETF | 1.87 | |

| 3-7 Year Treasury Bond ETF | 1.22 | |

| TIPS Bond ETF | 1.72 | |

| High Yield Corporate Bond ETF | 0.71 | |

| 1-3 Year Treasury Bond ETF | 0.46 |

Summary

✅ In summary, long-duration Treasury Bonds have significantly outperformed, supported by a favorable interest rate environment. Investors with a risk-averse stance may consider diversifying across shorter durations to mitigate potential volatility. Meanwhile, High Yield and TIPS Bonds remain attractive for their yield and inflation protection features. Future strategies should consider potential interest rate fluctuations and macroeconomic uncertainties that could impact bond valuations.