May 01, 2025 a 08:38 pm

BSX: Analysts Ratings - Boston Scientific Corporation

Boston Scientific Corporation, a leader in medical devices, continues to experience strong market valuations driven by its innovative product offerings across multiple medical specialties. The company's resilience and adaptability make it a favorable choice among analysts, with recent evaluation trends indicating a consistent appreciation in its market stance. Current analyst ratings predominantly suggest a positive outlook, contributing to an optimistic sentiment surrounding the company's stock. The analysis below delves deeper into the historical performance, sentiment shifts, and recommendations that shape the investment landscape for Boston Scientific.

Historical Stock Grades

Recent data reflects a steady incline in Boston Scientific's analyst ratings, with a strong emphasis on 'Buy' and 'Strong Buy' classifications. Despite a minor decline in 'Strong Buy' recommendations over the past year, the overall sentiment remains positive with no adverse 'Sell' ratings recorded.

| Recommendation | Count | Score Bar |

|---|---|---|

| Strong Buy | 7 | |

| Buy | 23 | |

| Hold | 4 | |

| Sell | 0 | |

| Strong Sell | 0 |

Sentiment Development

Over recent months, the sentiment towards Boston Scientific has shown an upward trend in positive recommendations, with a noticeable increase in 'Buy' and 'Strong Buy' classifications. This trend signals a growing confidence in the company's strategic direction and potential future performance.

- The total number of recommendations has remained relatively stable, signifying consistent interest and review by analysts.

- 'Strong Buy' ratings have seen a slight decline from 12 in October 2024 to 7 in May 2025, indicating cautious optimism.

- 'Buy' ratings have remained strong, providing a solid base for positive sentiment.

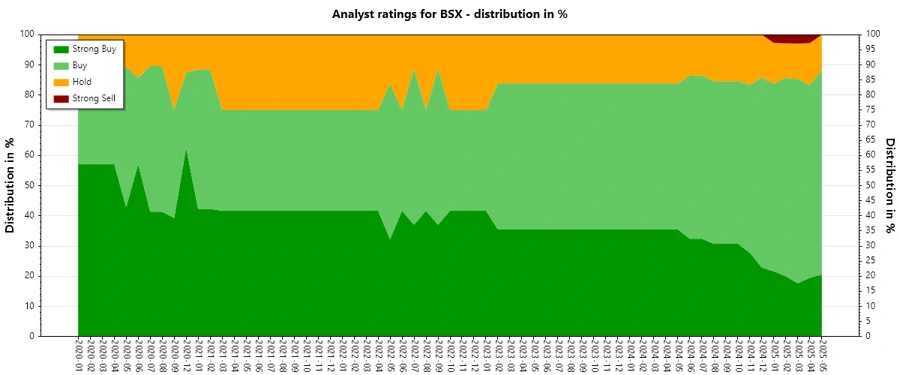

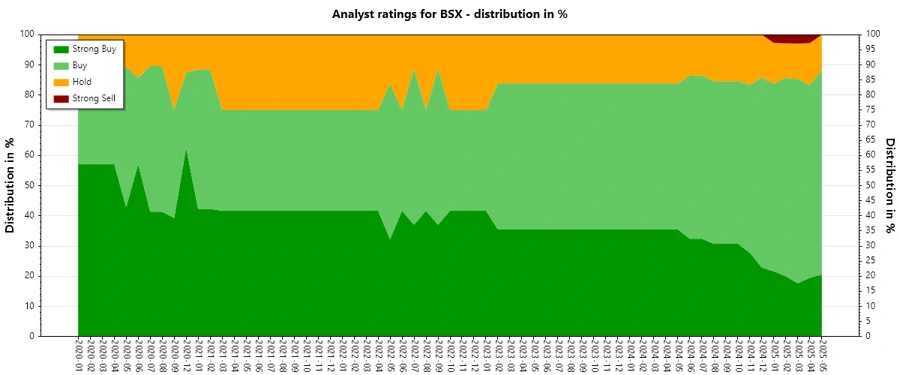

Percentage Trends

Percentage trends illustrate a stable distribution in analyst ratings, though there's a subtle shift favoring more conservative 'Hold' positions amid fluctuating 'Strong Buy' numbers. Analysts appear to be balancing enthusiasm with caution, as reflected in these ratings.

- Recent months depict a decline in 'Strong Buy' percentages from 35% in October 2024 to approximately 18% in May 2025, contrasting a stable 'Buy' percentage around 62%.

- 'Hold' ratings have consistently hovered around 10-15%, showing minor fluctuations.

- The gradual increase in 'Hold' ratings suggests a cautious approach among analysts, even as positive sentiment holds firm overall.

Latest Analyst Recommendations

The latest analyst recommendations continue to affirm Boston Scientific's stable market position, with consensus largely maintaining prior evaluations. Analyzing recent recommendations highlights sustained confidence in the company's market strategies.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-04-25 | Overweight | Overweight | Barclays |

| 2025-04-24 | Outperform | Outperform | Evercore ISI Group |

| 2025-04-24 | Buy | Buy | Truist Securities |

| 2025-04-24 | Buy | Buy | Needham |

| 2025-04-24 | Outperform | Outperform | Baird |

Analyst Recommendations with Change of Opinion

Recent adjustments in analyst recommendations reveal strategic realignments as analysts revise their outlook based on Boston Scientific's evolving market dynamics. These shifts offer insights into changing perceptions and future expectations.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-04-16 | Buy | Hold | Needham |

| 2024-10-18 | Hold | Buy | Needham |

| 2024-02-01 | Buy | Neutral | Mizuho |

| 2022-05-27 | Buy | Hold | Needham |

| 2022-05-26 | Buy | Hold | Needham |

Interpretation

Analyzing the market sentiment towards Boston Scientific reveals a robust confidence in its strategic and operational capabilities. The consistent 'Buy' recommendations highlight a favorable long-term view, though recent downgrades in 'Strong Buy' and upgrades in 'Hold' ratings suggest a reflective market approach. The absence of adverse 'Sell' ratings implies ongoing trust in the company's direction and stability. These elements cumulatively indicate a cautiously optimistic market stance with potential for growth tempered by market realities.

Conclusion

In summary, Boston Scientific Corporation stands out with a largely positive analyst consensus, highlighting its strong market position and innovative momentum. While recent months have seen a gentle decline in 'Strong Buy' ratings, the sustained 'Buy' recommendations suggest resilience and potential for future appreciation. The company's diverse product offerings and strategic agility continue to nurture confidence among analysts. Potential investors should weigh the inherent growth prospects against the evolving competitive landscape and market conditions. As the sector adapts, Boston Scientific's ability to maintain and enhance its market leadership will be crucial for sustaining its favorable stock evaluations.