July 28, 2025 a 03:15 pm

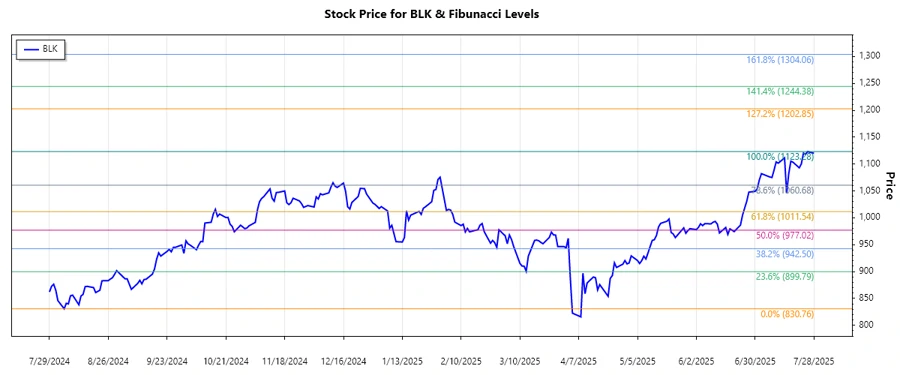

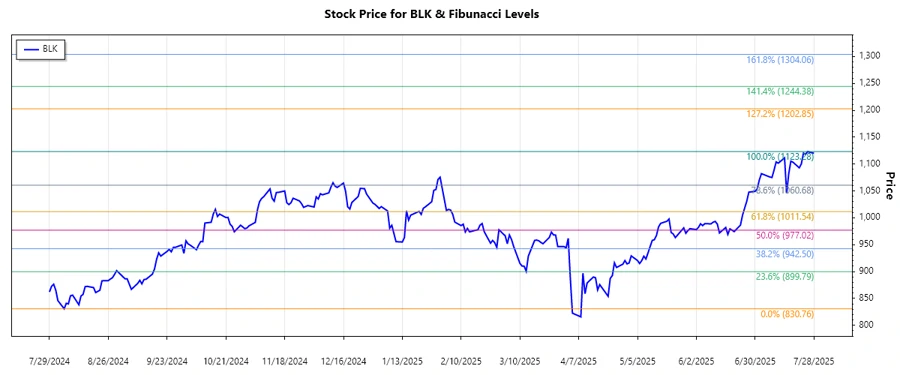

BLK: Fibonacci Analysis - BlackRock, Inc.

BlackRock, Inc. remains a cornerstone in investment management with its expansive services and asset management offerings. Recently, the stock has been on an upward trajectory, signaling a robust market confidence in its institutional and individual investment strategies. The technical analysis suggests potential support at specific retracement levels, offering strategic entry points for investors considering long positions.

Fibonacci Analysis

| Detail | Information |

|---|---|

| Start Date of Trend | 2024-08-01 |

| End Date of Trend | 2025-07-28 |

| Highest Price | $1123.28 on 2025-07-25 |

| Lowest Price | $830.76 on 2024-08-05 |

| Fibonacci Level | Price |

|---|---|

| 0.236 | $972.51 |

| 0.382 | $1010.29 |

| 0.5 | $1077.02 |

| 0.618 | $1043.75 |

| 0.786 | $1083.70 |

The current price of $1120 is above the 0.786 retracement level, indicating that the stock is in a strong uptrend beyond typical retracement zones. Historically, this suggests potential upwards momentum could continue, with retracement levels acting as support upon any price pullbacks.

Conclusion

BlackRock, Inc. displays a bullish trend, reflective of its expanding global investment reach and diversified asset strategies. Current analysis indicates the stock price has surpassed its key retracement levels, which can be interpreted as enduring market optimism. Risks include potential market or political volatility impacting its global operations, while opportunities present themselves in the form of strategic acquisitions or sector expansion. Analysts should weigh both technical signals and fundamental indicators to maintain a balanced perspective.