May 29, 2025 a 03:44 pm

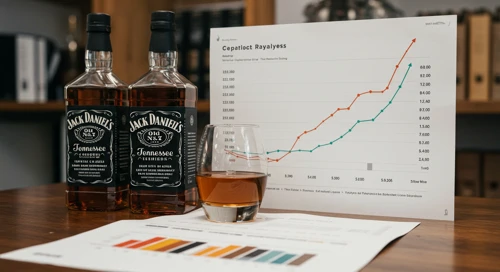

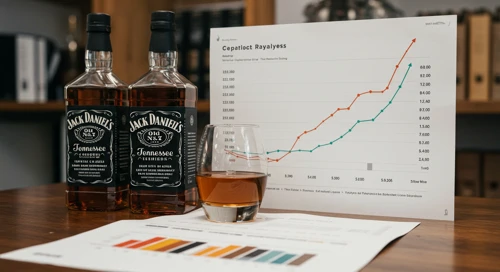

BF-B: Fundamental Ratio Analysis - Brown-Forman Corporation

The Brown-Forman Corporation (BF-B) is a well-established player in the beverages industry, renowned for its diverse portfolio of popular alcoholic brands. Despite facing industry challenges, the company maintains a solid market position and continues to demonstrate resilience through strategic domestic and international operations.

Fundamental Rating

The Brown-Forman Corporation holds a respectable 'B+' rating, reflecting its robust financial health and promising return on equity and assets, despite a moderate debt-to-equity ratio.

| Category | Score | Visualization |

|---|---|---|

| Overall | 3 | |

| Discounted Cash Flow | 3 | |

| Return on Equity | 5 | |

| Return on Assets | 5 | |

| Debt to Equity | 2 | |

| Price to Earnings | 3 | |

| Price to Book | 1 |

Historical Rating

The historical data provides insight into the stability of Brown-Forman's financial metrics over time, showcasing consistent scores.

| Date | Overall | DCF | ROE | ROA | D/E | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-05-28 | 3 | 3 | 5 | 5 | 2 | 3 | 1 |

| [Previous Date] | 3 | 3 | 5 | 5 | 2 | 3 | 1 |

Analyst Price Targets

Analysts' price targets for Brown-Forman are currently unavailable, indicating a period of market unpredictability or data refresh delay.

| High | Low | Median | Consensus |

|---|---|---|---|

| 0 | 0 | 0 | 0 |

Analyst Sentiment

The sentiment among analysts exhibits a predominant 'Hold' position, suggesting a cautious outlook towards the stock.

| Recommendation | Count | Visualization |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 6 | |

| Hold | 20 | |

| Sell | 5 | |

| Strong Sell | 0 |

Conclusion

Brown-Forman Corporation maintains a stable yet cautious position in the market, with strong fundamentals reflected in its ratings, notably in ROE and ROA. While the absence of updated analyst price targets suggests market volatility, the prevailing 'Hold' sentiment implies steady performance without substantial volatility. Investors may find reliability in its established brand portfolio but should remain attentive to industry shifts and potential risks, such as fluctuating market conditions impacting its global operations. Overall, BF-B represents a resilient investment with moderate growth prospects.