October 13, 2025 a 11:45 am

BF-B: Fibonacci Analysis - Brown-Forman Corporation

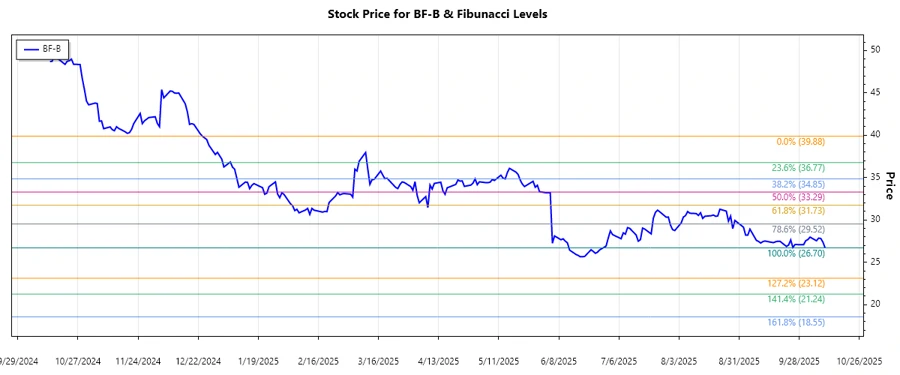

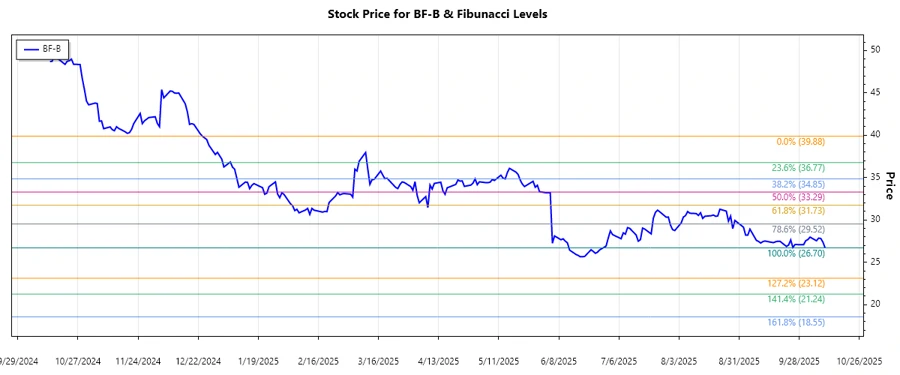

The Brown-Forman Corporation has been a prominent player in the alcoholic beverages market, with established brands like Jack Daniel's and Herradura. The stock shows notable cyclical behavior, influenced largely by broader market conditions and consumer trends. Recent data indicates a downward trend, suggesting caution. Technical indicators must be closely monitored for potential support levels.

Fibonacci Analysis

Recent analysis over the last few months reveals a downward trend in the Brown-Forman Corporation stock. This analysis aims to explore potential support levels through Fibonacci retracement.

| Trend Analysis | Details |

|---|---|

| Start Date | 2024-12-24 |

| End Date | 2025-10-10 |

| High Price and Date | $39.88 on 2024-12-24 |

| Low Price and Date | $26.7 on 2025-10-10 |

Using the highest and lowest price points, the Fibonacci retracement levels are calculated as follows:

| Fibonacci Level | Price |

|---|---|

| 0.236 | $34.89 |

| 0.382 | $33.13 |

| 0.5 | $32.29 |

| 0.618 | $31.44 |

| 0.786 | $30.18 |

The current price is within the 0.786 retracement zone, indicating potential resistance. This suggests a possible support level as market participants look for purchasing opportunities at this technical point.

Conclusion

The technical analysis of Brown-Forman Corporation's stock proposes that the stock is experiencing a significant retracement, with potential support identified at the 0.786 Fibonacci level. For analysts, this suggests cautious optimism for potential rebound opportunities. Given the sector's cyclical nature, continued external observation is necessary to adapt to shifting market dynamics.