April 20, 2025 a 08:31 am

BEN: Analysts Ratings - Franklin Resources, Inc.

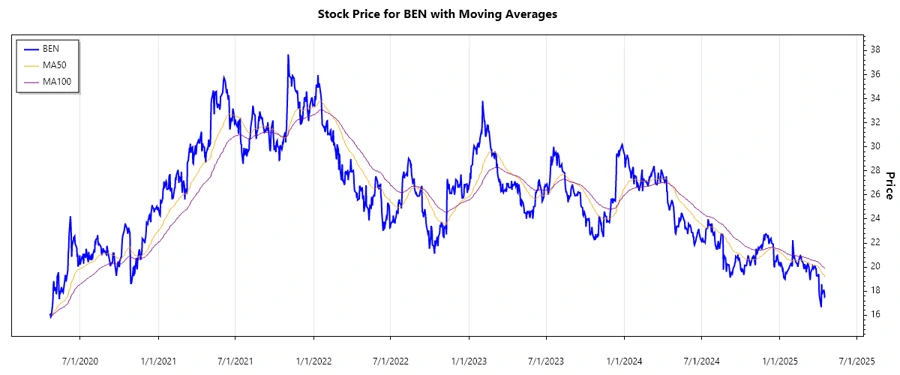

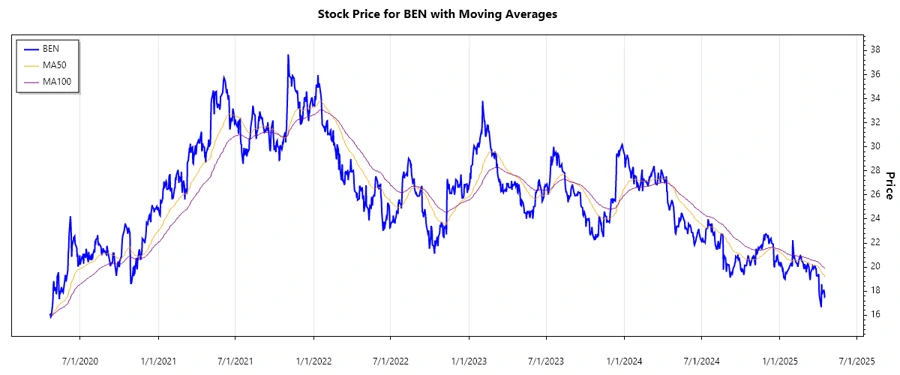

Franklin Resources, Inc. continues to navigate the complex asset management landscape with diverse offerings in equity, fixed income, and multi-asset strategies. While the company's long-standing presence in the market provides stability, the recent trends in analyst ratings suggest a cautious outlook with a focus on conservative strategies. The predominance of 'Hold' recommendations highlights a sentiment of watchful waiting among analysts.

Historical Stock Grades

| Rating | Count | Score |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 0 | |

| Hold | 7 | |

| Sell | 2 | |

| Strong Sell | 2 |

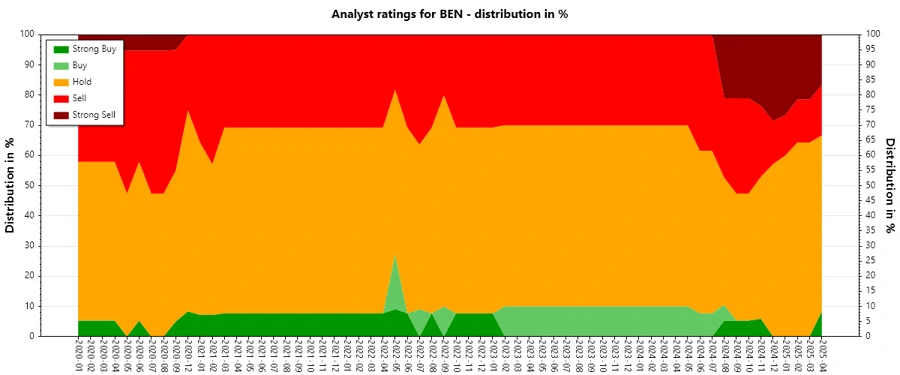

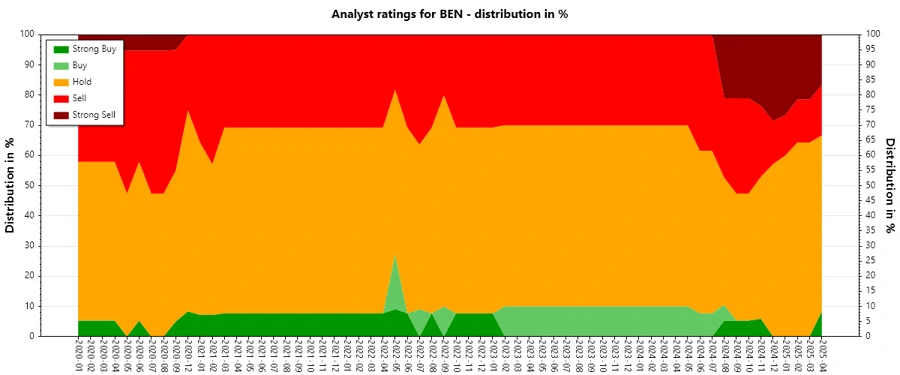

Sentiment Development

The sentiment towards Franklin Resources, Inc. has shown variability over recent months, with notable fluctuations in the 'Hold' and 'Strong Sell' categories. While 'Hold' ratings have remained relatively stable, the number of 'Strong Sell' ratings increased recently, reflecting a more cautious outlook. This indicates increased analyst uncertainty about the company's short-term prospects, despite its historical stability.

- Consistent hold ratings depict an overall cautiousness among analysts.

- Recent months show an uptick in 'Strong Sell' ratings, suggesting growing concerns.

- Slight increase in 'Strong Buy' ratings also points to potential long-term value for strategic buyers.

Percentage Trends

The period under review shows fluctuating percentage distributions of analyst ratings for Franklin Resources, Inc. The prominence of 'Hold' is declining consistently, while 'Strong Sell' ratings are becoming more frequent, indicating heightened caution. Observing the shifts in percentages provides insights into changing market sentiments and perceptions about growth potential and risks.

- 'Strong Buy': Remained low, currently around 10% while seeing no significant increase.

- 'Hold': Displays a declining trend, now composing around 60% of total ratings.

- 'Strong Sell': Saw a rise from around 15% to 20% in recent reviews, reflecting growing uncertainty.

Latest Analyst Recommendations

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-04-16 | Underweight | Underweight | Barclays |

| 2025-04-14 | Neutral | Neutral | Goldman Sachs |

| 2025-04-11 | Underperform | Underperform | Evercore ISI Group |

| 2025-04-09 | Hold | Hold | TD Cowen |

| 2025-04-08 | Equal Weight | Equal Weight | Wells Fargo |

Analyst Recommendations with Change of Opinion

The recommendations reveal a mix of stability and shifts among analysts' opinions. Key instances of upgrades and downgrades reflect evaluations adjusting to market conditions and company performance indicators.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-01-08 | Equal Weight | Underweight | Wells Fargo |

| 2022-09-08 | Underperform | Neutral | B of A Securities |

| 2022-09-07 | Underperform | Neutral | B of A Securities |

| 2022-06-29 | Underperform | Market Perform | Keefe, Bruyette & Woods |

| 2022-06-28 | Underperform | Market Perform | Keefe, Bruyette & Woods |

Interpretation

The analysis of Franklin Resources, Inc. suggests a nuanced market view where analyst sentiment appears cautious but not overwhelmingly negative. The predominance of 'Hold' ratings implies a prevailing stand-by approach, waiting for clearer signals in either direction. Recent increases in 'Strong Sell' ratings hint at emerging concerns, potentially about market conditions or firm-specific challenges. However, constant 'Hold' and occasional 'Strong Buy' ratings reflect enduring confidence in the company's long-term potential. The stability in recent recommendations with minimal upgrades or downgrades indicates confidence in the company's established strategies.

Conclusion

The trends in analyst ratings for Franklin Resources, Inc. indicate a cautious market approach, with a predominant tendency to 'Hold'. Analysts seem wary amid rising 'Strong Sell' recommendations, yet remain mindful of the company's established market position. While recent market conditions have bred caution, the absence of significant downgrades represents an underlying confidence in the company. Strategic decisions by potential investors should balance risks considering these mixed assessments, ensuring a thorough evaluation of both market signals and company fundamentals. Overall, Franklin Resources, Inc. stands at a crossroads, where tactical patience might be rewarded if the prevailing conditions shift favorably.