October 24, 2025 a 09:01 pm

BAX: Analysts Ratings - Baxter International Inc.

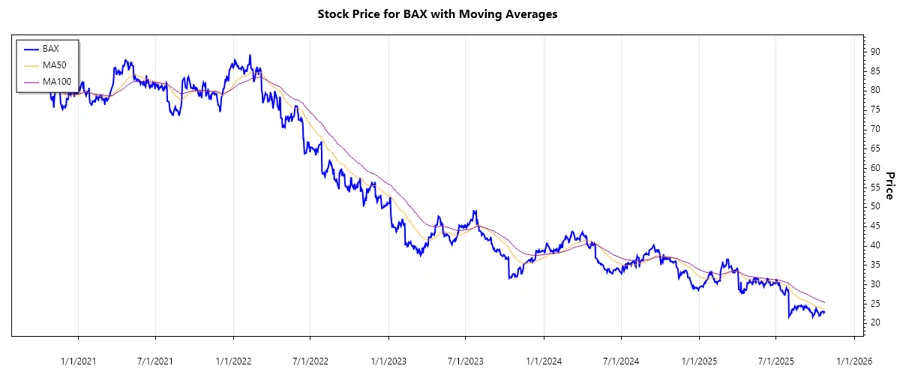

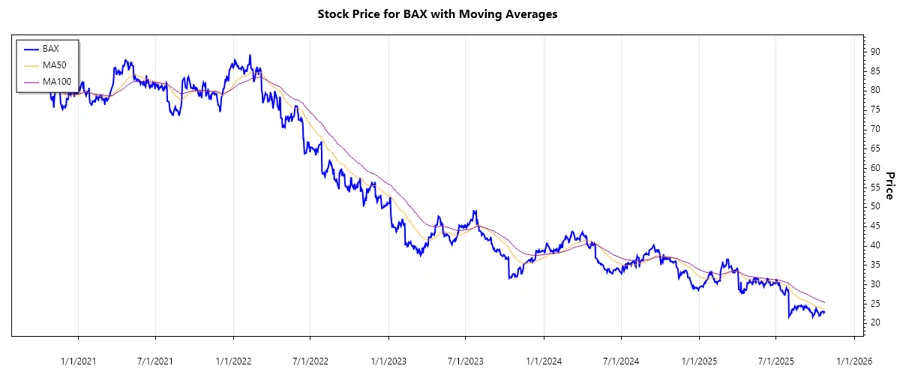

Baxter International Inc. operates in a complex healthcare ecosystem, offering a diverse portfolio of products and services globally. Recent analyst ratings suggest a cautious market approach, with a notable increase in 'Hold' recommendations. This shift could indicate growing market uncertainties or a more neutral outlook on the stock's immediate potential. Monitoring these trends is essential for stakeholders looking to navigate the evolving sentiment around Baxter's market position.

Historical Stock Grades

| Category | Count | Score |

|---|---|---|

| Strong Buy | 1 | |

| Buy | 3 | |

| Hold | 12 | |

| Sell | 1 | |

| Strong Sell | 0 |

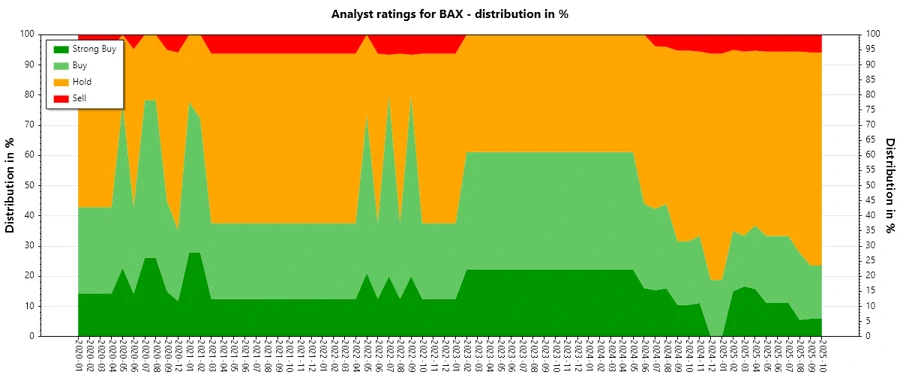

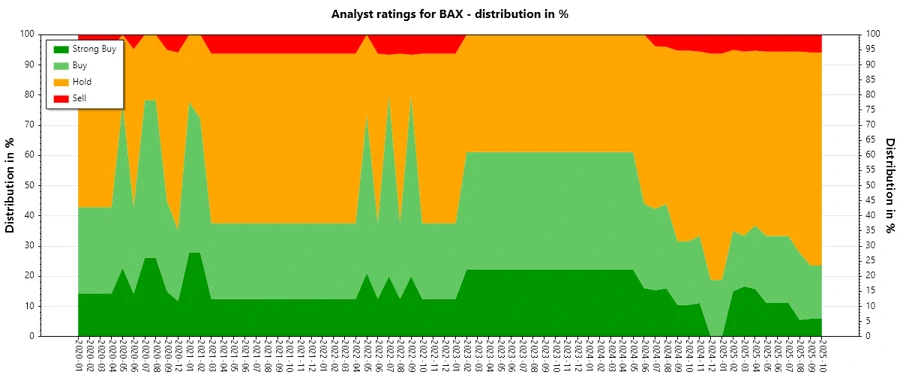

Sentiment Development

The sentiment towards Baxter International has shown a tangible shift over recent months. While some categories, such as 'Hold', have seen an increase, others like 'Strong Buy' have decreased, indicating more cautious investor sentiment.

- Overall ratings counts stayed consistent, with slight variations.

- 'Strong Buy' ratings retracted from higher levels seen in previous months.

- The 'Hold' category has gained prominence, reflecting market caution.

Percentage Trends

There have been noticeable shifts in the percentage of each rating category over months, with a clear trend towards a more conservative stance from analysts. The decline in 'Strong Buy' percentages and increase in 'Hold' suggests expectations for stability rather than aggressive upside.

- Strong Buy recommendations decreased from 20% to 5% over the past year.

- Hold ratings captured the largest share, increasing from 30% to 60%.

- A gradual yet steady decline in buying momentum is evident.

Latest Analyst Recommendations

Recent analyst recommendations reflect a stable approach, with most analysts maintaining their previous outlooks. A slight trend towards more conservative stances is noteworthy.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-10-07 | Outperform | Outperform | Evercore ISI Group |

| 2025-08-04 | Overweight | Overweight | Barclays |

| 2025-08-04 | Hold | Buy | Stifel |

| 2025-08-04 | Neutral | Neutral | UBS |

| 2025-08-01 | Equal Weight | Equal Weight | Wells Fargo |

Analyst Recommendations with Change of Opinion

There has been some movement in opinions with certain analysts downgrading their recommendations. While not prevalent, these changes are critical to watch for potential implications.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-08-04 | Hold | Buy | Stifel |

| 2024-07-15 | Underweight | Equal Weight | Morgan Stanley |

| 2024-05-10 | Hold | Buy | TD Cowen |

| 2023-01-06 | Equal Weight | Overweight | Morgan Stanley |

| 2023-01-05 | Equal Weight | Overweight | Morgan Stanley |

Interpretation

The current analyst sentiment towards Baxter International suggests a cautious market with limited immediate upside potential. With 'Hold' ratings dominating, it's clear that there is a focus on stability within the stock's performance. The overall sentiment indicates a level of uncertainty rather than strong confidence in swift growth. Analysts seem to be prioritizing a wait-and-see approach, possibly due to market conditions or sector-specific challenges.

Conclusion

Baxter International Inc. is currently experiencing a period of cautious sentiment, with analysts largely suggesting to 'Hold'. This reflects a broader trend of market hesitation, possibly due to external factors impacting the healthcare sector. While the company's diversified portfolio offers resilience against market fluctuations, the lack of strong buy recommendations suggests limited aggressive growth prospects in the short term. Investors should consider the potential for stability against the backdrop of an uncertain economic outlook. The evolving analyst sentiment serves as a reminder of the importance of strategic patience when considering Baxter as part of a diversified portfolio.