May 19, 2025 a 12:31 pm

Countries - Performance Analysis

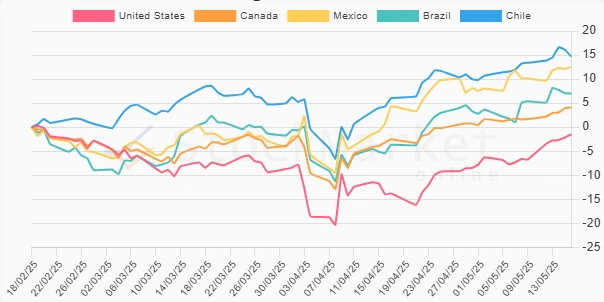

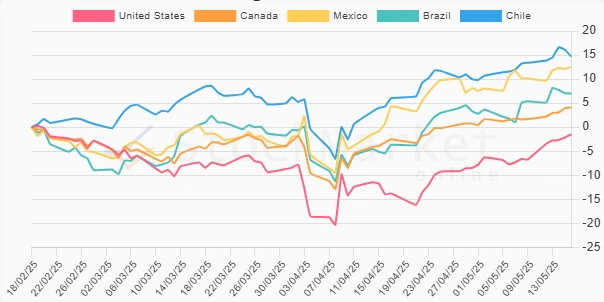

📊 The analysis focuses on the recent performance trends of select American countries over three distinct time periods: one week, one month, and three months. By examining these periods, we identify top performers and gain insights into regional economic conditions and market sentiments. Methodically outlining each country's movement helps investors and analysts position their strategies effectively.

Countries Performance - One Week

🗣️ Over the past week, Mexico emerged as the leading performer with a notable gain of 2.86%, suggesting positive news or economic conditions. In contrast, Chile exhibited the lowest growth at 0.84%, indicating a potential slowdown or adverse factors affecting its market dynamics.

| Country | Performance (%) | Performance |

|---|---|---|

| Mexico | 2.86 | |

| United States | 1.92 | |

| Brazil | 1.89 | |

| Canada | 1.87 | |

| Chile | 0.84 |

Countries Performance - One Month

📈 Over the month, the United States recorded an impressive rise of 12.29%, indicating strong market confidence. Canada, although positive, lagged with a more moderate 6.60% increase. This may highlight divergent macroeconomic factors influencing these nations.

| Country | Performance (%) | Performance |

|---|---|---|

| United States | 12.29 | |

| Brazil | 10.69 | |

| Chile | 8.65 | |

| Mexico | 8.21 | |

| Canada | 6.60 |

Countries Performance - Three Months

📉 Chile led the three-month category with a remarkable gain of 14.71%, reflecting robust economic performance or favorable policy changes. Conversely, the United States showed a decline of -1.51%, suggesting economic headwinds or market corrections.

| Country | Performance (%) | Performance |

|---|---|---|

| Chile | 14.71 | |

| Mexico | 12.55 | |

| Brazil | 7.02 | |

| Canada | 4.10 | |

| United States | -1.51 |

Summary

🔍 The analyses reveal dynamic shifts within the American markets over varying periods, with Mexico, Chile, and the United States showing significant but varied performances across the timelines. Understanding these fluctuations is crucial for strategizing investments and adjusting economic outlooks. Future considerations should include geopolitical influences, commodity prices, and banking sector health as they play pivotal roles in market performance.