November 14, 2025 a 04:28 am

AUDUSD: Trend and Support & Resistance Analysis

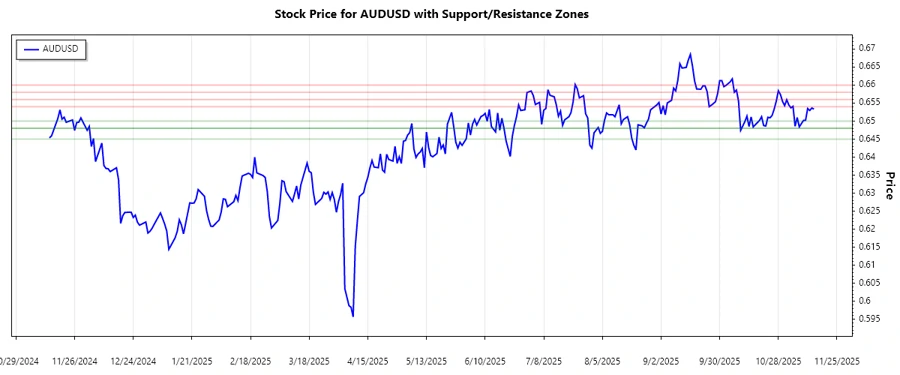

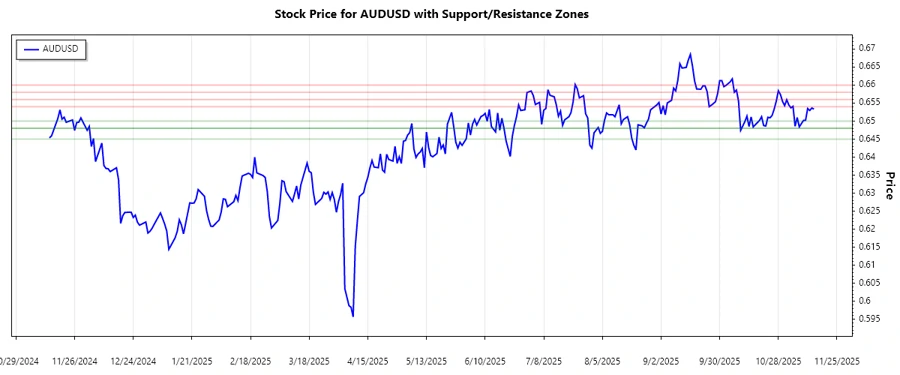

The AUDUSD currency pair has demonstrated varied movements over the past months, influenced by global economic factors and monetary policies. As of the latest data, the currency is showing signs of consolidation after a period of volatility. Traders and analysts should monitor upcoming economic indicators for potential impacts on the trend.

Trend Analysis

After analyzing historical price data for the AUDUSD over recent months, it becomes evident that the fluctuations have created a moderate market environment. With the current EMA20 at 0.65320 and EMA50 at 0.65350, there is a slight deviation indicating a ⚖️ sideways trend. The data suggests caution as such patterns could lead to sudden volatility.

| Date | Close Price | Trend |

|---|---|---|

| 2025-11-14 | 0.65332 | ⚖️ |

| 2025-11-13 | 0.65364 | ⚖️ |

| 2025-11-12 | 0.65295 | ⚖️ |

| 2025-11-11 | 0.65349 | ⚖️ |

| 2025-11-10 | 0.65024 | ▼ |

| 2025-11-09 | 0.65019 | ▼ |

| 2025-11-07 | 0.64839 | ▼ |

Technical indicators suggest a neutral stance in the coming days, but vigilance is advised for any economic news that could trigger shifts in momentum.

Support and Resistance

The identified support and resistance levels for the AUDUSD are crucial markers for traders. The current price hovers near a key resistance zone, which might indicate potential reversals or confirm existing trends.

| Zone Type | From | To | Trend |

|---|---|---|---|

| Support 1 | 0.64800 | 0.65000 | ▲ |

| Support 2 | 0.64500 | 0.64800 | ▲ |

| Resistance 1 | 0.65400 | 0.65600 | ▼ |

| Resistance 2 | 0.65800 | 0.66000 | ▼ |

The currency is currently nearing its first resistance zone, indicating that careful monitoring is necessary as it might experience rejections or breakthroughs.

Conclusion

The AUDUSD currency pair presents a balanced opportunity for traders in the FX market. With a neutral trend currently in place, the currency pair is at a crossroads, waiting for clear signals. Potential risks include economic announcements that could sway the pair either way, while opportunities may arise from exploiting trendlines near key support or resistance levels. Analysts should continue to monitor the market closely to discern any emerging patterns.