May 21, 2025 a 04:28 am

AUDNZD: Trend and Support & Resistance Analysis

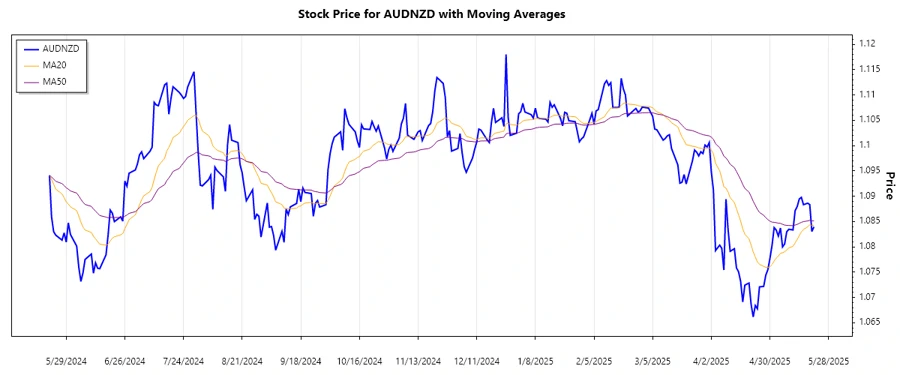

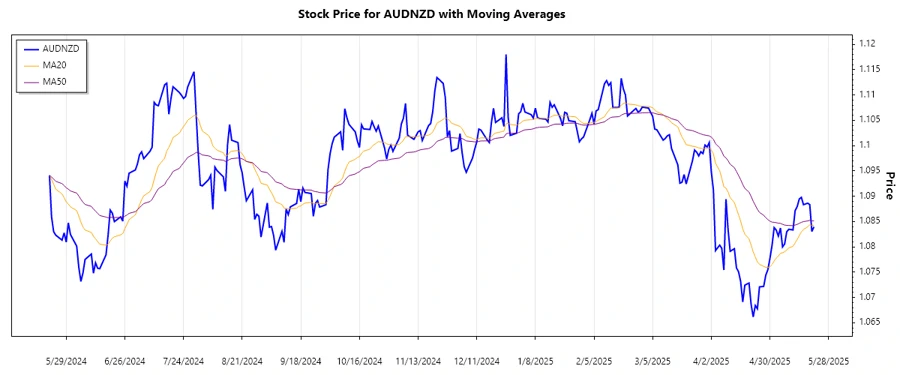

The AUDNZD currency pair has experienced dynamic shifts over the past months. Despite fluctuations, the prevailing trend appears to be consolidating, following a recent correction. Support and resistance levels are becoming more prominent, suggesting potential trading opportunities. This analysis will explore the current technical landscape of the AUDNZD pair.

Trend Analysis

Detailed insights based on recent data highlight the presence of a moderate downward trajectory for AUDNZD. Computing the EMAs shows that the recent price movements gravitated towards an equilibrium, suggesting potential newer trends. Here, the most recent seven-day breakdown with corresponding analysis is presented:

| Date | Close Price | Trend |

|---|---|---|

| 2025-05-21 | 1.08395 | ⚖️ Side Trend |

| 2025-05-20 | 1.08303 | ▼ Downward |

| 2025-05-19 | 1.08834 | ▼ Downward |

| 2025-05-18 | 1.08862 | ▼ Downward |

| 2025-05-16 | 1.08832 | ▼ Downward |

| 2025-05-15 | 1.08977 | ▼ Downward |

| 2025-05-14 | 1.08946 | ▼ Downward |

The technical assessment indicates that we are in a cautiously bearish phase. Investors should watch closely for signs of an EMA crossover before drawing firm conclusions about a trend reversal.

Support- and Resistance

An analysis of the support and resistance zones reveals pivotal market levels. The data below suggests where current market interactions could potentially face barriers:

| Zone | From | To |

|---|---|---|

| Support 1 | 1.07500 ▼ | 1.07800 ▼ |

| Support 2 | 1.06500 ▼ | 1.06800 ▼ |

| Resistance 1 | 1.09000 ▲ | 1.09300 ▲ |

| Resistance 2 | 1.10000 ▲ | 1.10300 ▲ |

Current trading levels position AUDNZD close to major support zones, suggesting potential builds or corrective rebounds. Traders should remain observant for either breakout or reversal patterns taking shape.

Conclusion

The recent behavior of the AUDNZD pair reflects a searching consolidative pattern. With defined support and resistance zones, traders gain a clearer framework for decision-making. While there's evident downside pressure, opportunities for range trading or possible rebounds could present. Appreciating both the dynamics and potential risks could better equip analysts and traders to navigate forthcoming market shifts.