September 22, 2025 a 05:08 am

AUDJPY: Fibonacci Analysis

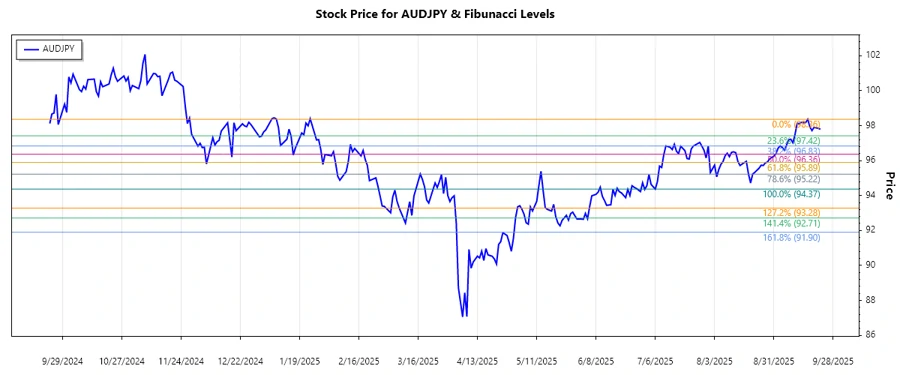

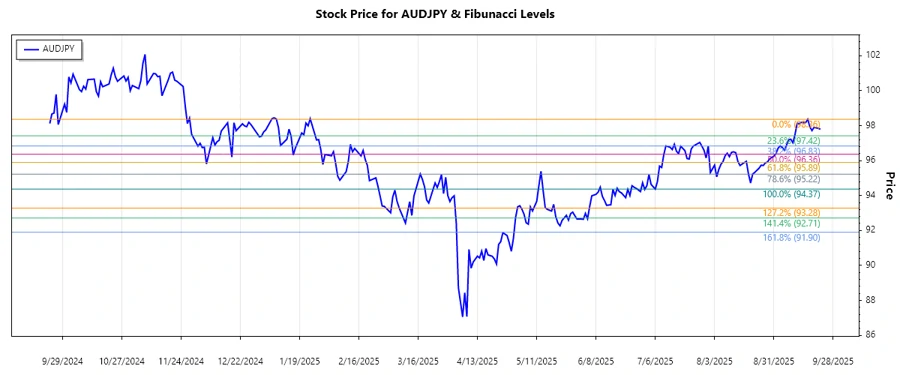

The AUDJPY currency pair has shown considerable movements over the past months. Currently, the trend has been predominantly bearish, with the currency pair seeing lower highs and lower lows. This behavior suggests potential uncertainties in the market, likely driven by macroeconomic factors affecting both Australia and Japan. Investors are advised to monitor key economic indicators and geopolitical developments for a comprehensive understanding of future movements.

Fibonacci Analysis

| Metric | Details |

|---|---|

| Trend Period | 2025-07-01 to 2025-09-22 |

| High Price & Date | 98.36 on 2025-09-16 |

| Low Price & Date | 94.366 on 2025-07-06 |

| Fibonacci Level | Price Level |

|---|---|

| 0.236 | 95.470 |

| 0.382 | 96.248 |

| 0.5 | 96.863 |

| 0.618 | 97.478 |

| 0.786 | 98.213 |

The current price of AUDJPY is within the 0.5 Fibonacci retracement range, suggesting it might be a critical support area. If it holds, the currency pair might rebound, otherwise further decline towards deeper retracement levels.

From a technical standpoint, this area acts as a strong support, and breaching it might indicate further downward pressures.

Conclusion

In conclusion, the AUDJPY has displayed a significant bearish trend recently, which opens potential opportunities for short positions should the trend persist. However, the presence at the 0.5 Fibonacci level suggests a possible reversal or temporary hold on the decline. Analysts should watch for confirmations of either a bounce or a break of this level to determine future price actions. The risks involved include sudden economic announcements or geopolitical developments that can cause abrupt changes in trend direction. Overall, while the current technical indicators suggest caution, they also provide insights into potential entry points for opportunistic investors.