January 29, 2026 a 04:28 am

AUDCAD: Trend and Support & Resistance Analysis

The recent trend for the AUDCAD currency pair shows a significant bullish momentum over the last few months. With consistent higher highs and higher lows, the currency pair has demonstrated resilience against economic pressures. Investors have been optimistic, pushing the pair's value upwards. However, it's crucial to remain attentive to potential economic changes that could influence future movements.

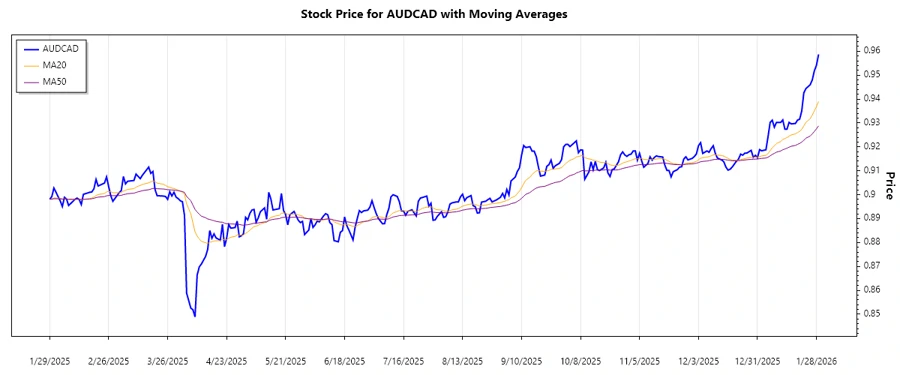

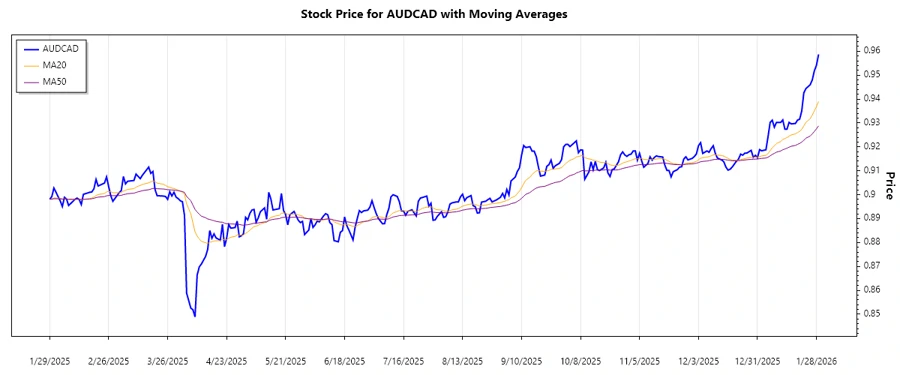

Trend Analysis

A thorough analysis of the AUDCAD daily closing prices shows a predominant uptrend. Calculating the EMA20 and EMA50 reveals that the EMA20 is consistently above the EMA50, confirming the upward momentum in the market. Here's a closer look at the data from the last 7 days:

| Date | Close Price | Trend |

|---|---|---|

| 2026-01-29 | 0.95867 | ▲ Bullish |

| 2026-01-28 | 0.95416 | ▲ Bullish |

| 2026-01-27 | 0.95181 | ▲ Bullish |

| 2026-01-26 | 0.94797 | ▲ Bullish |

| 2026-01-25 | 0.94595 | ▲ Bullish |

| 2026-01-23 | 0.94439 | ▲ Bullish |

| 2026-01-22 | 0.94263 | ▲ Bullish |

The consistent bullish trend as seen from the data above indicates robust buying interest in AUDCAD. Technical analysis suggests the potential for further upward movement if support levels continue to hold.

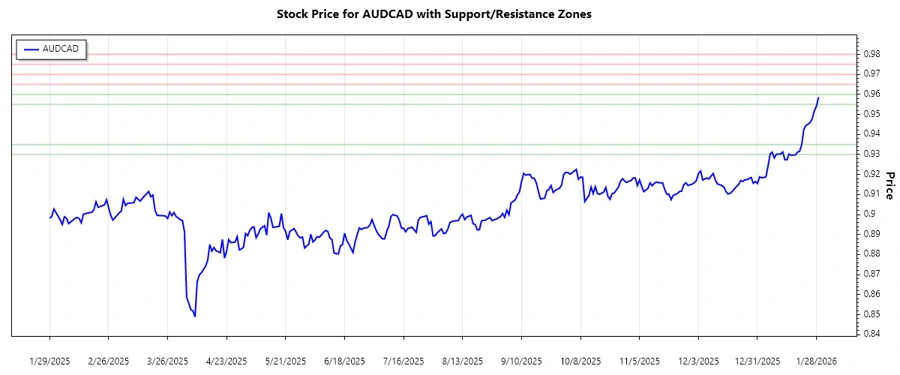

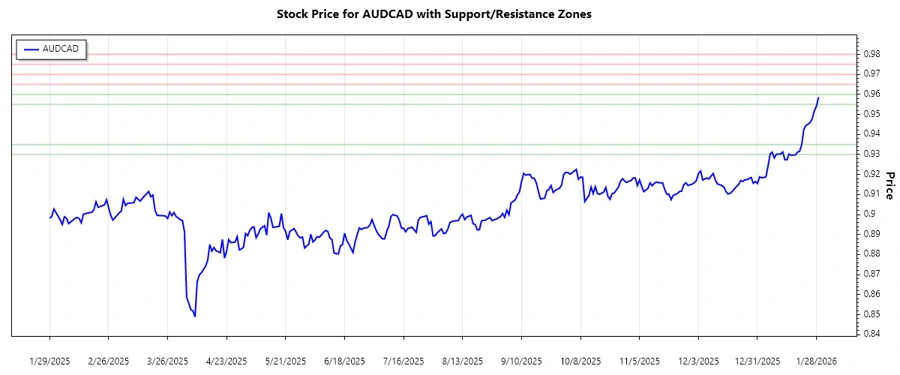

Support and Resistance Analysis

When we delve deeper into the charts, we identify key support and resistance zones. The calculated support zones are 0.93000 - 0.93500 and 0.95500 - 0.96000. The resistance zones are at 0.96500 - 0.97000 and 0.97500 - 0.98000.

| Zone Type | Zone Range |

|---|---|

| Support Zone 1 | 0.93000 - 0.93500 |

| Support Zone 2 | 0.95500 - 0.96000 |

| Resistance Zone 1 | 0.96500 - 0.97000 |

| Resistance Zone 2 | 0.97500 - 0.98000 |

The current price is hovering near the support zone, suggesting that the market participants might look to enter positions anticipating upward reversals.

Conclusion

In conclusion, the AUDCAD currency pair exhibits a strong upward trend strengthened by bullish investor sentiment. The observed support zones provide opportunities for entry points, while the resistance zones warrant caution as they may pose challenges to continued upward movement. Analysts should keep an eye on global economic conditions that could potentially disrupt the current trend.