July 20, 2025 a 05:08 am

AUDCAD: Fibonacci Analysis

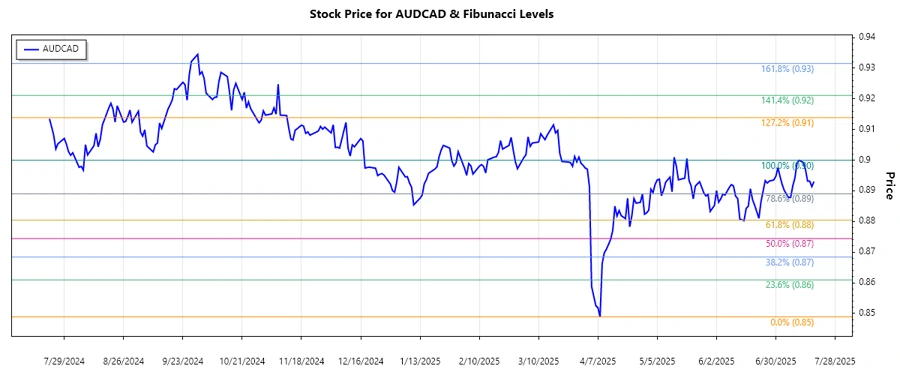

The AUDCAD currency pair has experienced fluctuations, showcasing a combination of economic factors from both the Australian and Canadian markets. Understanding the technical trends is essential for making informed trading decisions. Recently, there has been a notable trend that traders should keep an eye on. Analyzing such movements helps to identify potential support and resistance levels, giving traders valuable insight into future price directions.

Fibonacci Analysis

| Detail | Value |

|---|---|

| Trend Start Date | 2025-04-08 |

| Trend End Date | 2025-07-11 |

| Highest Point (Price/Date) | 0.89997 / 2025-07-11 |

| Lowest Point (Price/Date) | 0.84887 / 2025-04-08 |

| Fibonacci Level 0.236 | 0.86267 |

| Fibonacci Level 0.382 | 0.87300 |

| Fibonacci Level 0.5 | 0.87442 |

| Fibonacci Level 0.618 | 0.89117 |

| Fibonacci Level 0.786 | 0.88774 |

| Current Price Retracement Zone | 0.88645, currently between 0.618 and 0.786 |

| Technical Interpretation | The current price suggests a potential resistance at the 0.786 level, with the possibility of retracing towards lower Fibonacci levels if unable to breach the resistance. |

A detailed chart representing the AUDCAD movements and Fibonacci levels.

A detailed chart representing the AUDCAD movements and Fibonacci levels.

Conclusion

The AUDCAD presents both opportunities and risks for traders. With the current price nearing the 0.786 Fibonacci retracement level, traders need to remain vigilant about potential reversals. While the market may find resistance at this crucial level, breaking through could signify further upside potential. However, failure to maintain this level might indicate bearish pressure, leading to a retracement towards lower support levels. Traders should be prepared for both scenarios and manage their positions accordingly.