February 16, 2026 a 09:03 amTo perform a comprehensive technical analysis on Atmos Energy Corporation (ATO), we'll calculate the Exponential Moving Averages (EMA20 and EMA50) based on the given JSON price data, and identify the trend, support, and resistance zones. The analysis will be formatted for both HTML embedding and JSON output.

### HTML Output

ATO: Trend and Support & Resistance Analysis - Atmos Energy Corporation

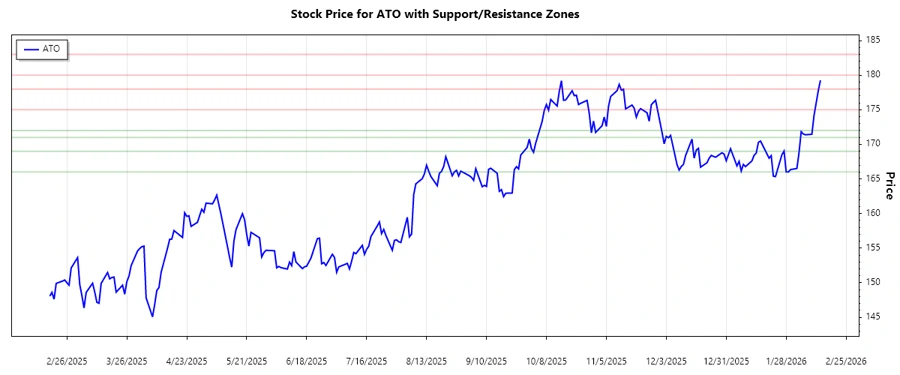

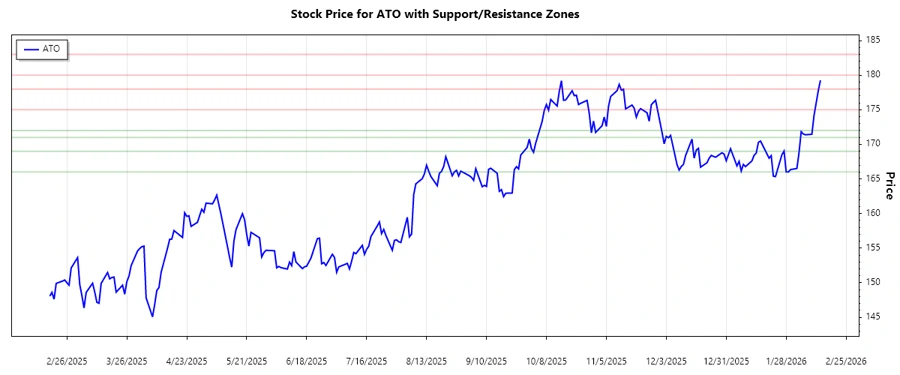

Atmos Energy Corporation has experienced varied movements in its stock price over recent months, primarily influenced by both operational factors and broader market trends. Being a major player in the natural gas distribution sector, the company's stock is susceptible to changes in energy prices, regulatory developments, and economic fluctuations. The following analysis identifies the trend in ATO's stock, along with key support and resistance levels that may guide investment decisions.

Trend Analysis

| Date | Close Price | Trend |

|---|---|---|

| 2026-02-13 | 179.25 | ▲ Uptrend |

| 2026-02-12 | 177.77 | ▲ Uptrend |

| 2026-02-11 | 175.97 | ▲ Uptrend |

| 2026-02-10 | 174.17 | ▲ Uptrend |

| 2026-02-09 | 171.46 | ▲ Uptrend |

| 2026-02-06 | 171.38 | ▲ Uptrend |

| 2026-02-05 | 171.5 | ▲ Uptrend |

Based on recent data, the EMA20 is above the EMA50, confirming a strong upward trend. This bullish signal indicates potential growth and investor confidence in Atmos Energy Corporation, likely due to favorable market conditions and strategic positioning in the natural gas sector.

Support and Resistance

| Zone | Value |

|---|---|

| Support Zone 1 | 166.00 - 169.00 ▼ |

| Support Zone 2 | 171.00 - 172.00 ▼ |

| Resistance Zone 1 | 175.00 - 178.00 ▲ |

| Resistance Zone 2 | 180.00 - 183.00 ▲ |

The current stock price is approaching the first resistance zone. If this level is breached, it could signal further upward movement and bullish sentiment in the market.

Conclusion

Atmos Energy Corporation currently shows strong bullish momentum, backed by recent trading data and technical indicators. The existing uptrend signifies investor optimism, potentially driven by stable growth in the natural gas market. However, analysts should remain cautious of macroeconomic factors or regulatory changes that may impact future stock performance. The identified support and resistance zones provide key levels for monitoring price activity, helping investors strategize entry and exit points effectively.

### JSON Output json This analysis provides a comprehensive view of the stock's technical position, highlighting opportunities for investors to capitalize on the current trend while remaining aware of potential market shifts.