September 22, 2025 a 10:15 am

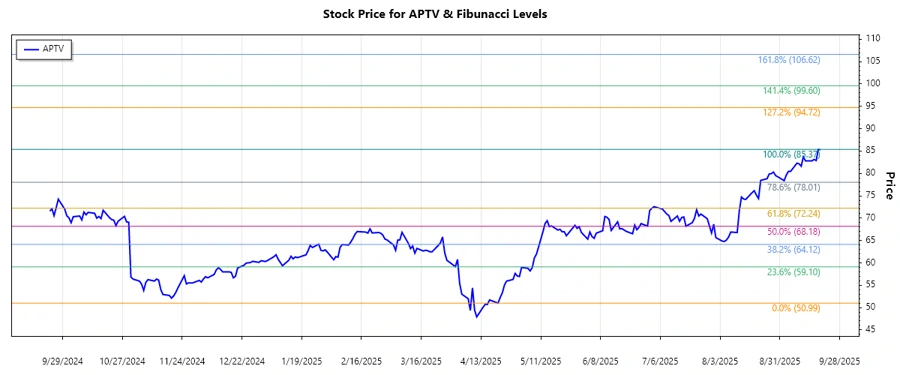

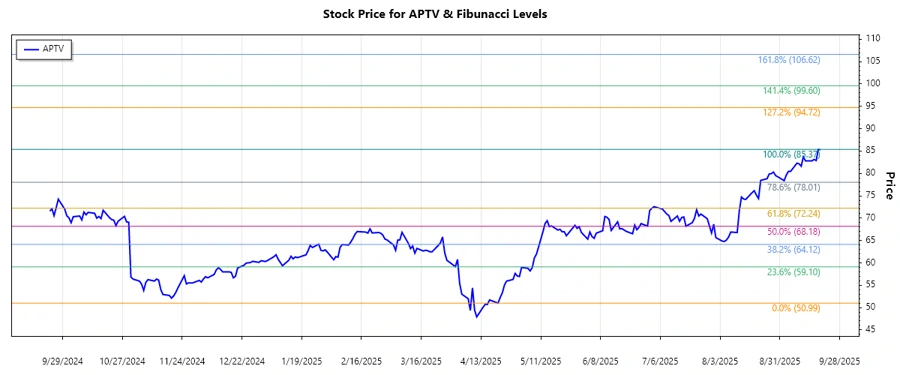

APTV: Fibonacci Analysis - Aptiv PLC

The Aptiv PLC stock has shown impressive performance over recent months, characterized by a significant uptrend. The company's focus on delivering cutting-edge electrical and safety solutions positions it well in the evolving automotive sector. Recent price movements reflect a growing investor confidence, driven by its robust market strategies and innovations in vehicle connectivity and safety technologies.

Fibonacci Analysis

| Detail | Value |

|---|---|

| Start Date | 2025-03-24 |

| End Date | 2025-09-19 |

| High Point (Price & Date) | $85.37 on 2025-09-18 |

| Low Point (Price & Date) | $50.99 on 2025-04-21 |

| Fibonacci Level 0.236 | $60.42 |

| Fibonacci Level 0.382 | $65.42 |

| Fibonacci Level 0.5 | $68.18 |

| Fibonacci Level 0.618 | $70.93 |

| Fibonacci Level 0.786 | $74.65 |

| Current Price Retracement Zone | None |

| Technical Interpretation | The current price of $85.28 is above all retracement levels, indicating a strong bullish momentum. The levels may serve as potential supports if a pullback occurs. |

Conclusion

Aptiv PLC's stock is positioned strongly in an uptrend, outperforming many peers in the automotive industry. The continuous development in vehicle safety and electronic architecture supports its growth trajectory. However, investors should be cautious of market corrections that may hit growth stocks. Currently, its price surpasses Fibonacci retracement levels, signifying robust market confidence. Analysts should closely monitor industry trends and technological shifts that may influence Aptiv's market position. A pullback to retracement levels could provide buying opportunities for investors seeking entry points.