October 15, 2025 a 08:15 am

APP: Trend and Support & Resistance Analysis - AppLovin Corporation

The recent performance of AppLovin Corporation's stock suggests a phase of volatility with opportunities for both strategic entry and caution. The presence of consistent innovations in their software solutions provides a strong foundation for future growth. Investors should closely monitor upcoming market conditions and updates to fully grasp the potential movements in the stock's value.

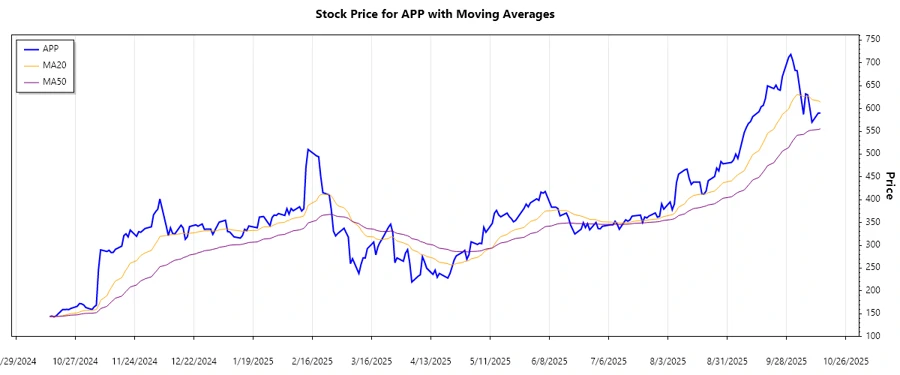

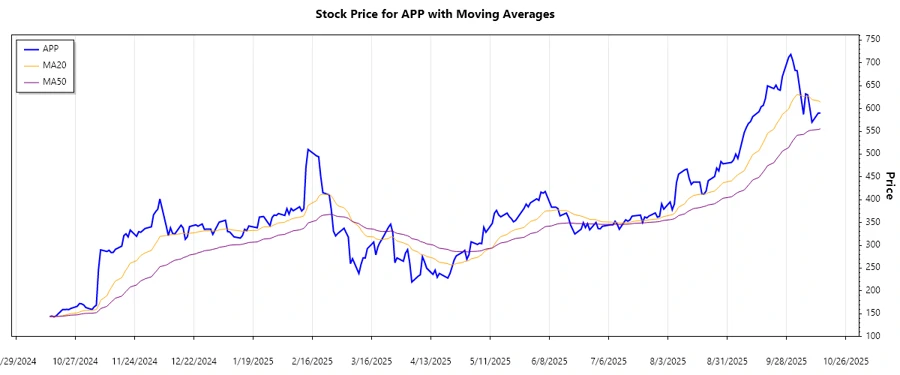

Trend Analysis

The trend analysis indicates that AppLovin Corporation has been navigating through diverse price changes in the given timeframe. To determine the current trend using the EMA (Exponential Moving Average), we computed the EMA20 and EMA50 from the closing prices:

| Date | Closing Price | Trend |

|---|---|---|

| 2025-10-14 | 590.03 | ▲ Up |

| 2025-10-13 | 590.11 | ▲ Up |

| 2025-10-10 | 569.89 | ▼ Down |

| 2025-10-09 | 600.32 | ▲ Up |

| 2025-10-08 | 629.70 | ▲ Up |

| 2025-10-07 | 631.85 | ▲ Up |

| 2025-10-06 | 587.00 | ▼ Down |

The EMAs suggest a predominant upward trend, with EMA20 often exceeding EMA50. This implies a positive trajectory for the stock, which can be attractive for prospective investors looking for growth stocks.

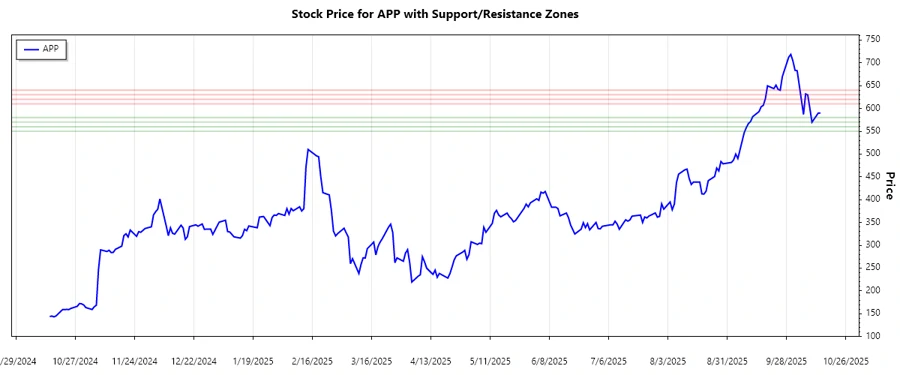

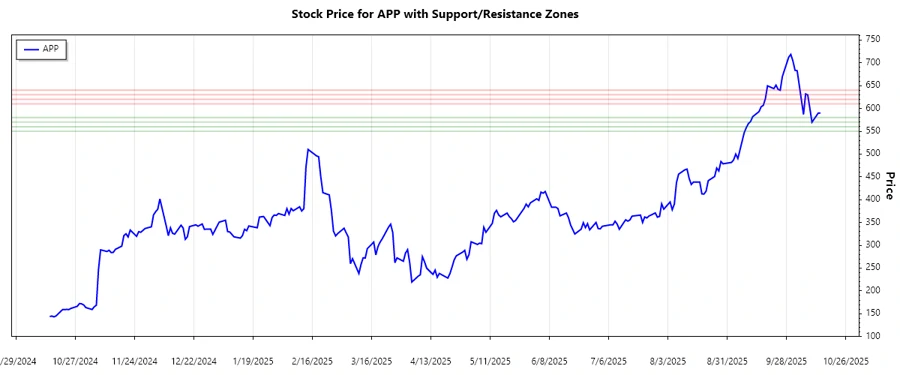

Support and Resistance

The support and resistance analysis identifies critical zones where the stock has shown signs of either rebound or resistance:

| Zone Type | Range | Direction |

|---|---|---|

| Support | 550.00 - 560.00 | - Sideways |

| Support | 570.00 - 580.00 | - Sideways |

| Resistance | 610.00 - 620.00 | - Down |

| Resistance | 630.00 - 640.00 | - Down |

Currently, the stock trades near the lower resistance zone, indicating potential challenges in breaching this level. Investors should be mindful of these zones to anticipate future market movements.

Conclusion

The recent analysis of AppLovin Corporation's stock reveals optimism with caution. The upward trend offers prospects for gains, but resistance zones impose hurdles that might deter instant upswings. The company's innovations position it well for the future, yet investors should be wary of market dips, particularly around identified resistance areas. Prudent analysis and diligent market observation remain key for stakeholders aiming to capitalize on this stock's dynamics.