September 24, 2025 a 01:01 pm

APP: Analysts Ratings - AppLovin Corporation

AppLovin Corporation, with its focus on enhancing mobile app marketing and monetization, has experienced a varied analyst sentiment over recent months. The company's robust software solutions cater to advertisers and publishers globally, positioning it uniquely in the market. Analyst ratings indicate a mix of confidence and caution, reflecting the competitive and dynamic nature of the digital advertising industry.

Historical Stock Grades

In September 2025, the analyst ratings for AppLovin Corporation show a strategic position with a focus on 'Buy,' comprising the majority opinion. The distribution highlights a cautious optimism toward the stock with a significant portion allocated to 'Hold' and minor indications of 'Sell' recommendations.

| Rating | Count | Score |

|---|---|---|

| Strong Buy | 4 | |

| Buy | 15 | |

| Hold | 4 | |

| Sell | 2 | |

| Strong Sell | 1 |

Sentiment Development

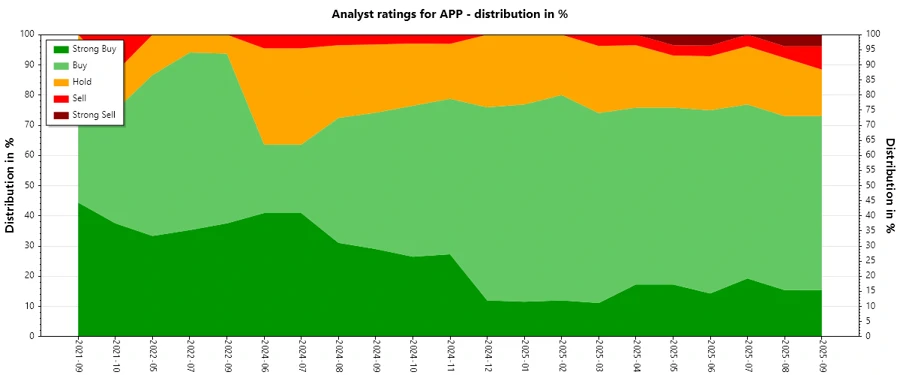

Over recent months, there has been a shift in analyst sentiment towards AppLovin Corporation. While 'Strong Buy' ratings have seen a decline, 'Buy' ratings maintain their dominance. 'Hold' suggestions saw a slight increase, indicating growing caution amongst analysts.

- Stable 'Buy' recommendations with slight variations month over month.

- Increase in 'Hold' ratings, reflecting potential market caution.

- 'Sell' and 'Strong Sell' recommendations remain low, suggesting a limited bearish outlook.

Percentage Trends

The analyst rating distribution for AppLovin presents intriguing shifts in percentages over the past months. Despite a nominal decrease in 'Strong Buy' percentages, there's a sustained preference for 'Buy'. The percentage of 'Hold' ratings has slightly risen, reflecting a cautious optimism among analysts.

- 'Strong Buy' Ratings: Decreased from 17% to 14%.

- 'Buy' ratings: Maintaining a steady level, though marginally declining from 62% to 58%.

- 'Hold' Ratings: Noticeable increase from 17% to 24% over recent months.

- Minimal changes in 'Sell' and 'Strong Sell' ratings, indicating limited bearish momentum.

Latest Analyst Recommendations

The recent recommendations for AppLovin Corporation illustrate a consistent stance among analysts. Maintenance of 'Buy' and 'Outperform' ratings signifies ongoing confidence in the stock's potential, guided by stable market conditions.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-09-15 | Buy | Buy | Benchmark |

| 2025-09-15 | Buy | Buy | BTIG |

| 2025-09-12 | Outperform | Outperform | Wedbush |

| 2025-09-05 | Buy | Buy | Jefferies |

| 2025-08-28 | Sector Outperform | Sector Outperform | Scotiabank |

Analyst Recommendations with Change of Opinion

Observations of changed opinions in analyst recommendations offer insights into shifting market perspectives. Notable upgrades by institutions such as Morgan Stanley and UBS hint at increased recognition of AppLovin's strategic positioning and growth prospects.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-04-10 | Overweight | Equal Weight | Morgan Stanley |

| 2024-11-08 | Outperform | Neutral | Daiwa Capital |

| 2024-10-14 | Neutral | Buy | Goldman Sachs |

| 2024-09-17 | Buy | Neutral | UBS |

| 2023-08-22 | Buy | Hold | Jefferies |

Interpretation

The current analyst sentiment towards AppLovin Corporation suggests a cautiously optimistic market perspective. Consistent 'Maintain' ratings indicate stability in analyst perspectives. However, the observed increase in 'Hold' ratings may suggest deliberations about competitive pressures or uncertainties within the digital advertising sector. Overall, the stock enjoys confidence but underlines a prudent approach among analysts.

Conclusion

AppLovin Corporation's strong foundation in mobile advertising positions it well in a growing industry. While current analyst scores highlight confidence, recent shifts towards more conservative 'Hold' ratings could signal caution over market volatility or competitive threats. The strategic upgrades from respected analysts encourage a positive long-term view. Potential investors should weigh these insights alongside external market conditions to make informed decisions.