August 13, 2025 a 01:00 pm

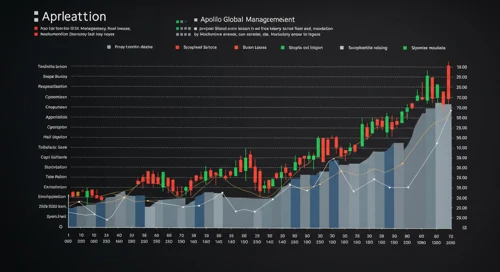

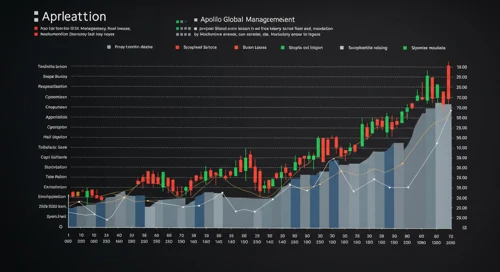

APO: Fundamental Ratio Analysis - Apollo Global Management, Inc.

Apollo Global Management (Ticker: APO) operates in global asset management, focusing on credit, private equity, and real estate markets. The firm's comprehensive approach and strategic investments across diversified sectors make it a key player in the financial services industry. Investors should consider the firm's global reach and expertise in structured credit and alternative investments when evaluating stock performance.

Fundamental Rating

Below is the fundamental rating of Apollo Global Management, Inc., showcasing its performance in vital financial categories.

| Category | Score | Visualization |

|---|---|---|

| Discounted Cash Flow | 3 | |

| Return on Equity | 5 | |

| Return on Assets | 3 | |

| Debt to Equity | 2 | |

| Price to Earnings | 1 | |

| Price to Book | 1 |

Historical Rating

Reviewing the historical rating provides insight into the firm’s performance progression over time:

| Date | Overall | DCF | ROE | ROA | D/E | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-08-12 | 3 | 3 | 5 | 3 | 2 | 1 | 1 |

| Null | 0 | 3 | 5 | 3 | 2 | 1 | 1 |

Analyst Price Targets

The following table outlines the analysts' projected price targets for Apollo Global Management, highlighting potential future performance:

| High | Low | Median | Consensus |

|---|---|---|---|

| $188 | $48 | $134 | $126.13 |

Analyst Sentiment

The table below showcases the current analyst sentiment regarding Apollo Global Management's stock, helping investors gauge market perceptions:

| Recommendation | Count | Visualization |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 24 | |

| Hold | 4 | |

| Sell | 0 | |

| Strong Sell | 0 |

Conclusion

Apollo Global Management presents a mixed investment opportunity with strong aspects in return on equity and a favorable analyst consensus reflecting a "Buy" sentiment. The firm exhibits potential growth supported by its global investments, although risks include its lower scores in price-to-earnings and debt-to-equity ratios. Investors should weigh the conservative historical performance against promising analyst targets. Diversified sector involvement may mitigate immediate risks while fostering long-term growth.