October 27, 2025 a 01:15 pm

ANET: Trend and Support & Resistance Analysis - Arista Networks, Inc.

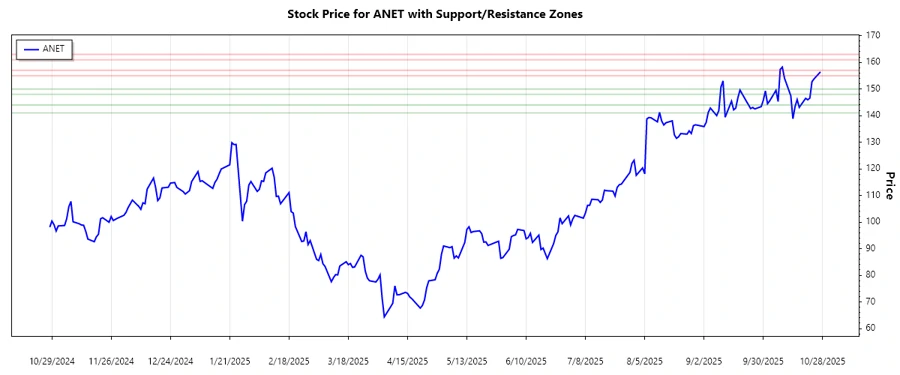

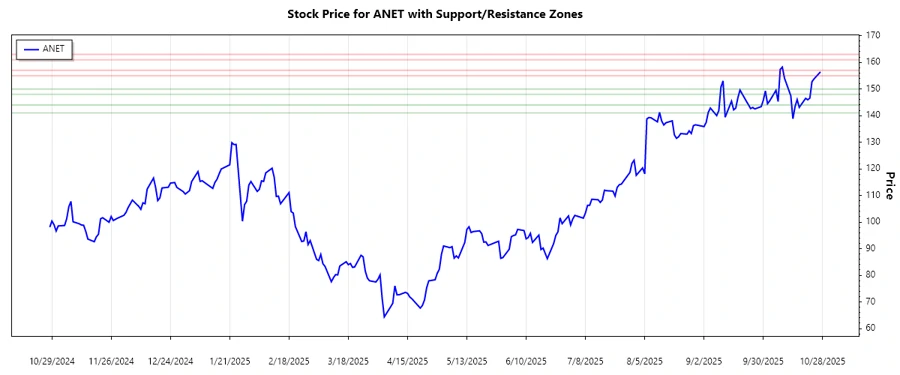

Arista Networks, Inc., a leading provider in cloud networking solutions, has been showing a dynamic market presence. Observing its price action over the past months, there are insightful movements that reflect potential opportunities and risks. Understanding these trends is crucial for strategizing future positions. This analysis focuses on identifying key trends and support-resistance zones to assist in technical assessment.

Trend Analysis

The analysis of Arista Networks, Inc. stock prices over the recent period shows dynamic movements with significant trends emerging. Calculating the exponential moving averages (EMA) reveals a moving average convergence, suggesting transitions in market sentiment:

| Date | Closing Price | Trend |

|---|---|---|

| 2025-10-27 | 156.42 | ▲ |

| 2025-10-24 | 153.82 | ▲ |

| 2025-10-23 | 152.76 | ▲ |

| 2025-10-22 | 146.59 | ▲ |

| 2025-10-21 | 145.94 | ▲ |

| 2025-10-20 | 146.48 | ▲ |

| 2025-10-17 | 143.10 | ▲ |

The calculated EMAs demonstrate that EMA20 is greater than EMA50, indicating a dominant upward trend. This suggests a positive market sentiment with increasing momentum.

Support and Resistance

Identifying support and resistance levels allows for an improved understanding of potential reversal points. Based on historical data, the following levels have been identified:

| Zone | From | To |

|---|---|---|

| Support 1 | 148.00 | 150.00 |

| Support 2 | 141.00 | 144.00 |

| Resistance 1 | 155.00 | 157.00 |

| Resistance 2 | 161.00 | 163.00 |

The latest closing position places Arista Networks, Inc. near the first resistance zone. Vigilance is advised as a breakthrough could signal further upward movement.

Conclusion

Arista Networks, Inc. shows a strong bullish trend with significant upward momentum. The EMA calculations reaffirm this trajectory with further potential upsurge projected if resistance levels are breached. Investors should monitor these levels for signals of continuation or reversal shifts. Technical factors coupled with the cloud networking growth narrative present a compelling scenario for long-term investing. Nonetheless, it's crucial to remain observant of broader market influences.