July 09, 2025 a 05:00 pm

AMZN: Analysts Ratings - Amazon.com, Inc.

The stock of Amazon.com, Inc. (AMZN) is widely followed by analysts, who generally hold a positive outlook. The company, with its diverse business operations including e-commerce, cloud computing, and digital streaming, continues to be a market leader. The current analyst ratings reflect strong confidence in the company’s growth prospects, despite some fluctuations in individual analyst opinions over time.

Historical Stock Grades

Analyzing the historical analyst ratings provides insights into the market sentiment towards Amazon.com, Inc. as of June 2025. The data indicates strong positive sentiment with a majority recommending 'Strong Buy' or 'Buy', underscoring the company's robustness and market position.

| Recommendation | Number | Score Visualization |

|---|---|---|

| Strong Buy | 19 | |

| Buy | 47 | |

| Hold | 4 | |

| Sell | 0 | |

| Strong Sell | 0 |

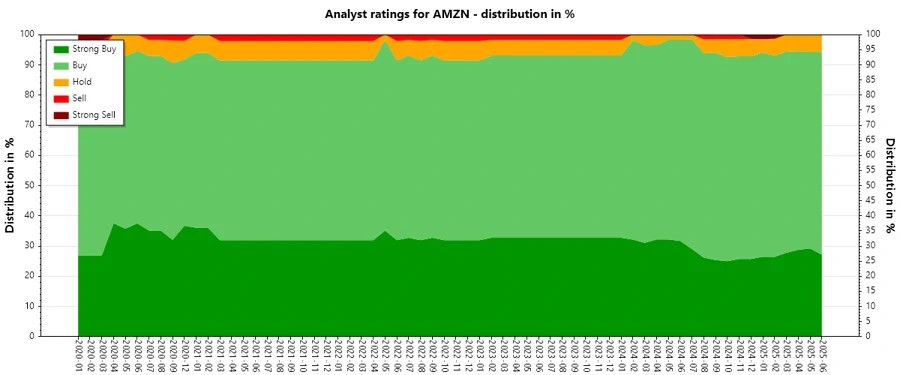

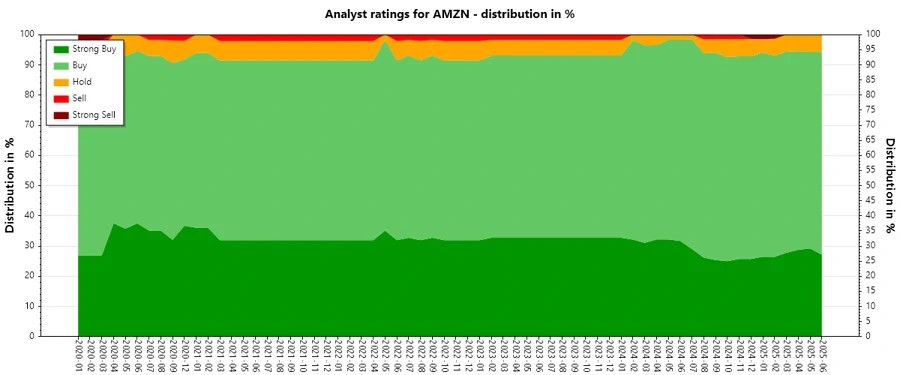

Visual representation of historical analyst recommendations for Amazon.com, Inc. showcasing trends over time.

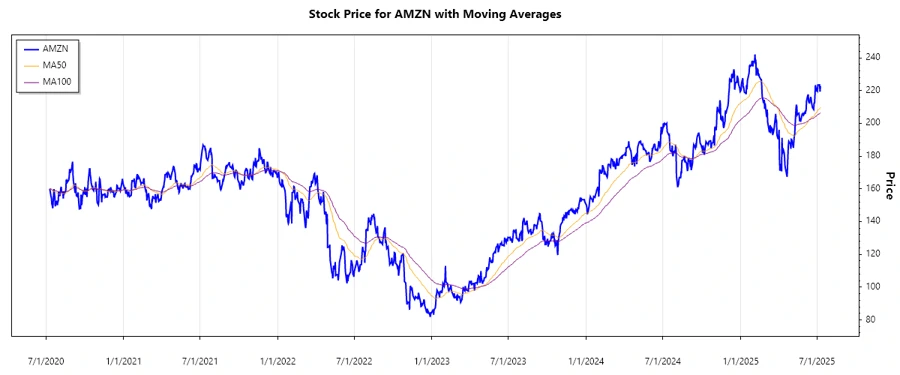

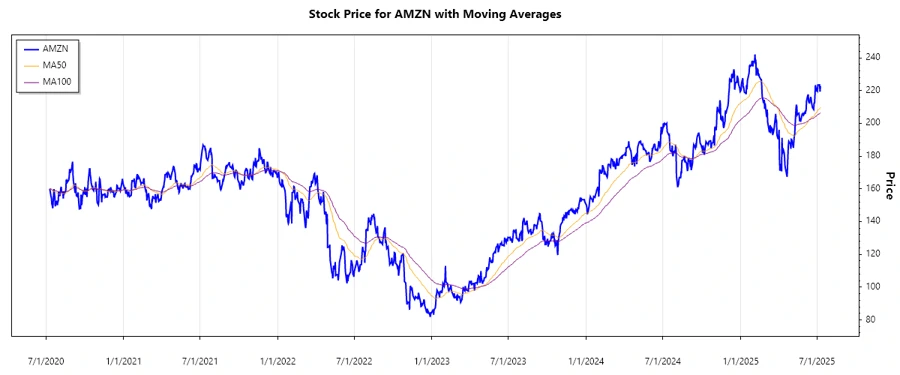

Stock performance chart of Amazon.com, Inc. indicating market response to analyst ratings.

Sentiment Development

The data reveals a consistent level of confidence among analysts in the potential of Amazon.com, Inc. Over recent months, there has been a slight decrease in 'Strong Buy' recommendations, with 'Buy' ratings remaining stable. This trend may suggest a careful optimism tempered by market conditions.

- Overall stability in ratings with minimal fluctuations.

- A slight decrease in 'Strong Buy' ratings in the previous months, indicating cautious optimism.

- Steady maintenance of 'Buy' ratings highlights enduring confidence in Amazon's business model.

Percentage Trends

The percentage allocation of analyst ratings displays a predominant confidence with a dominant 'Buy' preference. Although 'Hold' ratings have seen marginal increases, no significant shift toward pessimistic ratings like 'Sell' or 'Strong Sell' has been observed.

- 'Strong Buy' ratings have experienced a decline from 21 to 19 over recent months, indicating cautious optimism.

- 'Buy' ratings remain the majority, comprising nearly half of all ratings.

- The percentage of 'Strong Buy' ratings decreased from 31% to 25% in the last six months, while 'Buy' ratings increased to 62%.

- The subdued presence of 'Sell' or 'Strong Sell' ratings reflects sustained positive sentiment.

Latest Analyst Recommendations

Recent analyst recommendations reflect a period of stability with maintained ratings. The absence of downgrades in the latest assessments suggests ongoing confidence in Amazon’s performance.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-06-20 | Outperform | Outperform | Oppenheimer |

| 2025-06-04 | Overweight | Overweight | JP Morgan |

| 2025-06-02 | Buy | Buy | B of A Securities |

| 2025-05-06 | Buy | Buy | Tigress Financial |

| 2025-05-05 | Outperform | Outperform | Baird |

Analyst Recommendations with Change of Opinion

Whenever there is a change in analyst opinion, it provides vital insights into evolving market conditions or internal company developments. Recent downgrades might suggest reassessment in growth expectations for Amazon, while upgrades indicate increased confidence in strategic initiatives.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-04-21 | Outperform | Strong Buy | Raymond James |

| 2024-10-07 | Equal Weight | Overweight | Wells Fargo |

| 2023-08-04 | Neutral | Underperform | Exane BNP Paribas |

| 2023-08-04 | Buy | Neutral | Rosenblatt |

| 2023-08-03 | Neutral | Underperform | Exane BNP Paribas |

Interpretation

The overall sentiment around Amazon.com, Inc. remains positive with an overwhelming majority of analysts recommending either 'Buy' or 'Strong Buy'. The minor downgrades observed are offset by the stable long-term outlook signified by consistent 'Buy' ratings. This suggests confidence in Amazon's long-term strategic direction, despite short-term market uncertainties. Ratings transitions reflect typical market recalibrations rather than systemic concerns. Stability in recommendations highlights moderate but sustained market confidence.

Conclusion

Amazon.com, Inc. continues to maintain a strong position in the market, reflected in the high percentage of 'Buy' ratings and the absence of worrying 'Sell' recommendations. The firm’s diversified business structure and continuous innovation in cloud computing, AI, and retail contribute to the positive outlook. Analysts' consistent ratings reflect trust in Amazon’s growth potential while recent downgrades may denote caution. The company's ability to adapt and lead in multiple sectors provides significant upside, albeit with typical market risks. Overall, the outlook remains favorable, with analysts endorsing continued growth and resilience.