February 05, 2026 a 03:15 am

AMGN: Trend and Support & Resistance Analysis - Amgen Inc.

The analysis of Amgen Inc. (AMGN) reveals a strong upward trend over recent months, indicating a positive investor sentiment. This trend aligns with Amgen's consistent advancements in biopharmaceuticals, ensuring robust performance in the competitive landscape. With strategic collaborations and a focus on high-demand therapeutic areas, this secured growth trajectory positions Amgen for potential continued upside.

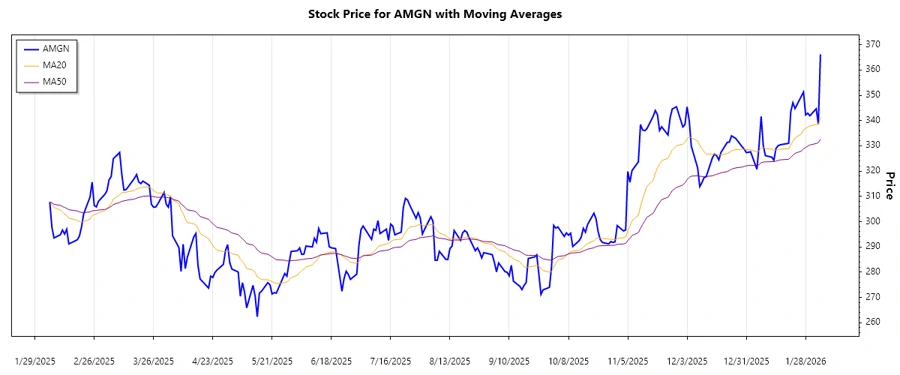

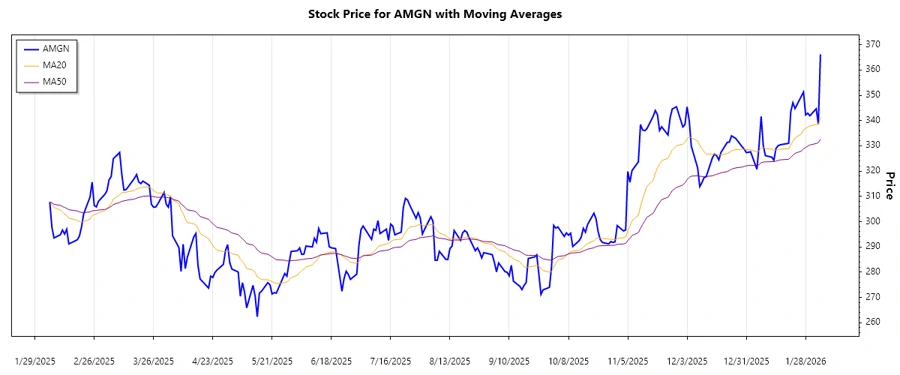

Trend Analysis

From the provided data, a detailed examination reveals a dominant upward trend in Amgen Inc.'s stock price over recent months. The EMA20 is greater than the EMA50 over the period, suggesting a sustained bullish momentum. Focusing on the last seven days, we can see a consistence above the EMA50, reaffirming the trend.

| Date | Close Price | Trend |

|---|---|---|

| 2026-02-04 | 366.2 | ▲ Strong Uptrend |

| 2026-02-03 | 338.59 | ▲ Uptrend |

| 2026-02-02 | 344.68 | ▲ Uptrend |

| 2026-01-30 | 341.88 | ▲ Uptrend |

| 2026-01-29 | 342.94 | ▲ Uptrend |

| 2026-01-28 | 342.22 | ▲ Uptrend |

| 2026-01-27 | 351.32 | ▲ Strong Uptrend |

This trend indicates strong investor confidence and potential further price appreciation, driven by Amgen's strategic initiatives and market conditions.

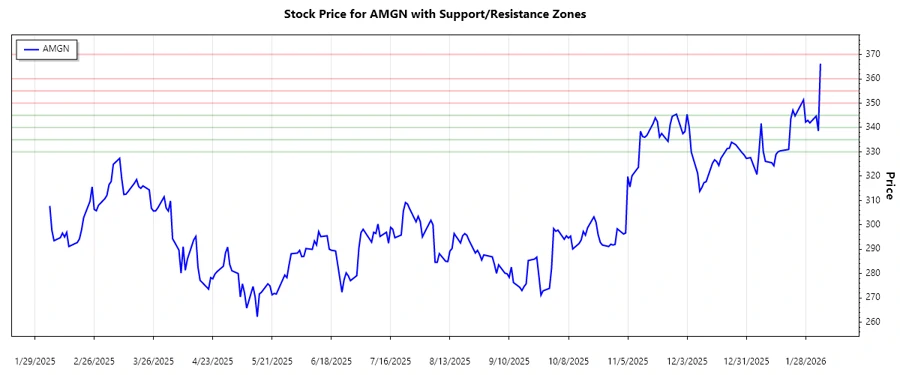

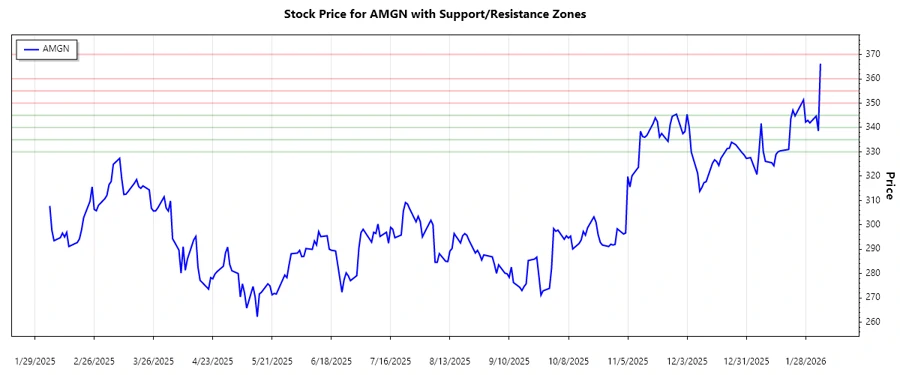

Support- and Resistance

The data analysis identifies key support and resistance zones critical for future price action prediction. The recent closing prices closely approach resistance zones, suggesting potential breakout scenarios if overcome.

| Zone Type | From | To | Status |

|---|---|---|---|

| Support Zone 1 | 330.00 | 335.00 | ▲ Support Holding |

| Support Zone 2 | 340.00 | 345.00 | ▲ Nearing Support |

| Resistance Zone 1 | 350.00 | 355.00 | ▼ Testing Resistance |

| Resistance Zone 2 | 360.00 | 370.00 | ▼ Approaching Resistance |

Currently, the price resides near key resistance zones, suggesting a possible bullish breakout if upward pressure continues.

Conclusion

The analysis of Amgen Inc. (AMGN) suggests promising investment potential, as evidenced by the pronounced uptrend and firm support levels. The interaction with resistance zones highlights the importance of monitoring for potential breakouts that could yield substantial gains. As Amgen continues to innovate and expand its product pipeline, the fundamental outlook complements the bullish technical indicators. However, traders should remain vigilant as market volatility and sector-specific challenges could introduce risks. Overall, momentum appears favorable for investors seeking growth opportunities in the biotech industry.