April 09, 2025 a 08:04 pm

AMGN: Trend and Support & Resistance Analysis - Amgen Inc.

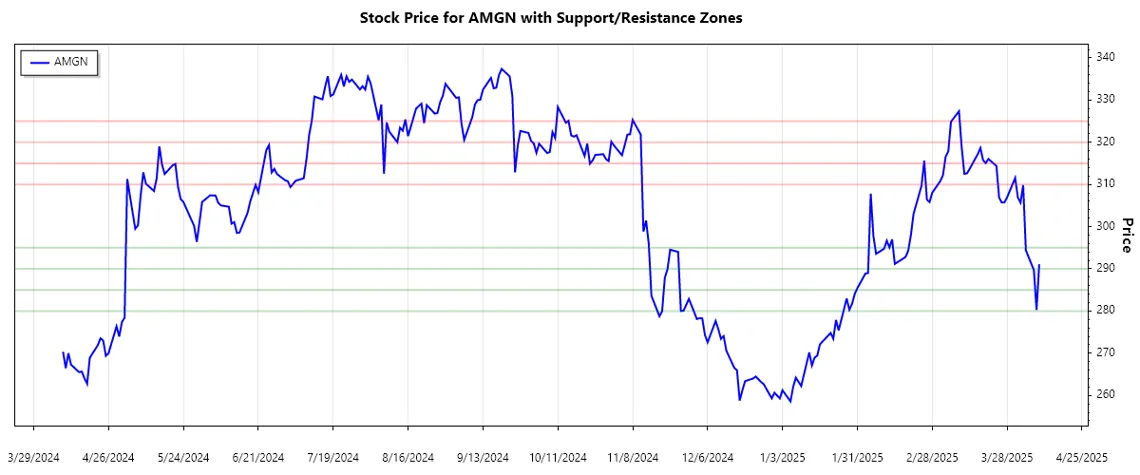

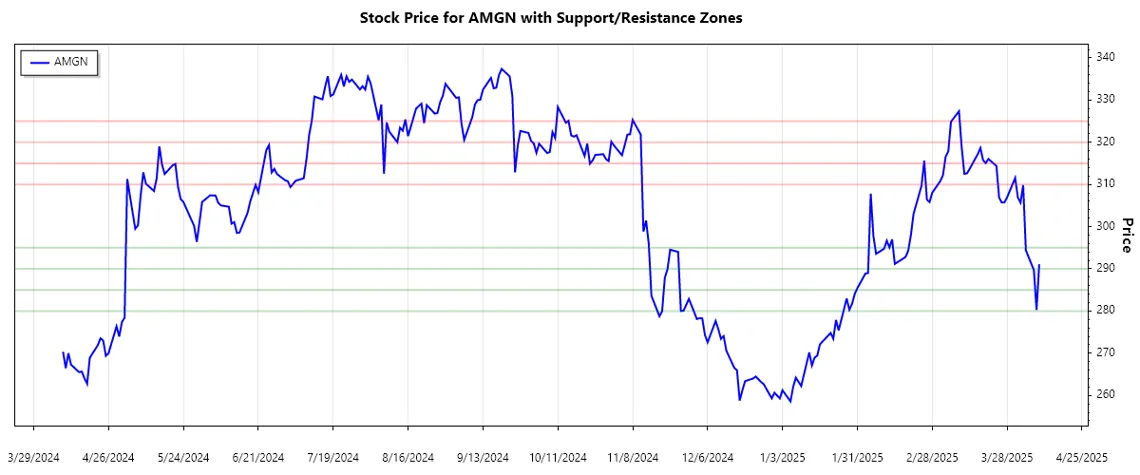

Amgen Inc. has shown significant volatility in its stock prices, reflecting broader market trends and specific industry challenges in the biotechnology space. Recent financial data indicates a potential shift in investor sentiment as new products enter the market. As one of the leading pharmaceutical companies, assessing its stock requires careful analysis of both short- and long-term trends to identify optimal investment opportunities.

Trend Analysis

The recent analysis of Amgen Inc.'s daily closing prices suggests mixed sentiment in the market. The calculation of exponential moving averages (EMAs) over 20 and 50 days shows a general bearish to neutral trend with slight recovery signs.

| Date | Close Price | Trend |

|---|---|---|

| 2025-04-09 | 291.09 | ▼ |

| 2025-04-08 | 280.26 | ▼ |

| 2025-04-07 | 289.69 | ▼ |

| 2025-04-04 | 294.39 | ▲ |

| 2025-04-03 | 309.85 | ▲ |

| 2025-04-02 | 305.7 | ▲ |

| 2025-04-01 | 306.92 | ▲ |

The current analysis indicates a short-term upswing, but to confirm a sustained upward trend, EMA20 should consistently remain above EMA50 over subsequent trading sessions.

Support- and Resistance

Upon technical review, several key support and resistance levels can be identified in Amgen Inc.'s stock price. These zones provide insight into possible price floors and caps in the current market framework.

| Zone Type | From | To |

|---|---|---|

| Support Zone 1 | 280.00 | 285.00 |

| Support Zone 2 | 290.00 | 295.00 |

| Resistance Zone 1 | 310.00 | 315.00 |

| Resistance Zone 2 | 320.00 | 325.00 |

The present price level is precariously close to the lower end of the determined support zone, indicating that any breach would suggest a more sustained downturn.

Conclusion

Amgen Inc.'s stock is now positioned in a delicate equilibrium between impending technological breakthroughs and market volatility. The company's footholds in biotechnology underscore potential growth vectors, yet the persistent market hesitations about drug pricing pose notable headwinds. Investors should stay wary of macroeconomic factors and regulatory shifts, which could pave contrary paths for AMGN shares. The stock's present range, positioned near critical support zones, merits close observation for those either holding or considering an entry.

And here is the JSON object representing the analysis: