May 29, 2025 a 05:00 pm

ALL: Analysts Ratings - The Allstate Corporation

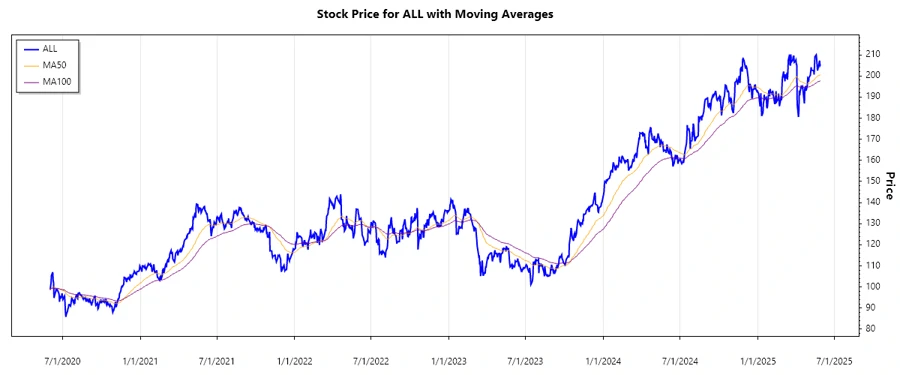

The Allstate Corporation, with a rich history since 1931, has established itself prominently in the insurance sector across the United States and Canada. Recent analyst ratings indicate a stable outlook with strong buy and buy ratings remaining consistent. However, the slight uptick in hold and strong sell ratings suggests some caution towards future market conditions. This overview provides a snapshot of current analyst sentiment towards Allstate, reflecting both opportunities and potential challenges.

Historical Stock Grades

| Rating Type | Count | Score |

|---|---|---|

| Strong Buy | 7 | |

| Buy | 9 | |

| Hold | 2 | |

| Sell | 1 | |

| Strong Sell | 2 |

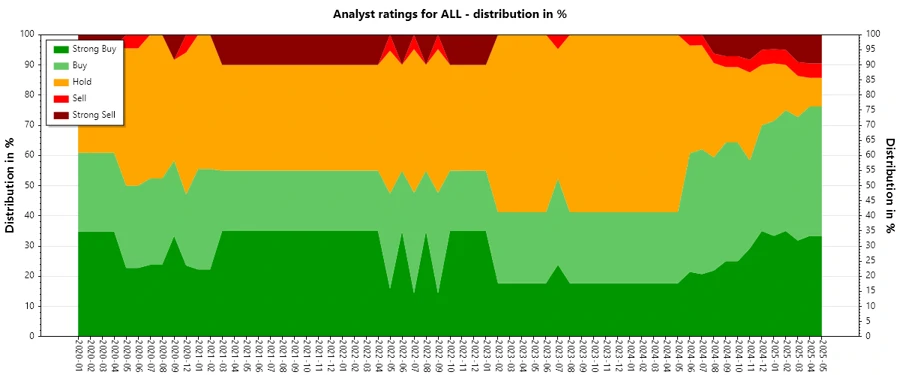

Sentiment Development

The sentiment towards Allstate has been relatively stable over recent months, with a sustained emphasis on buy ratings. A notable constancy in strong buy recommendations reflects ongoing confidence among analysts. However, there has been a slight shift with hold ratings seeing a minimal increase, indicating some cautious sentiment possibly related to market volatility.

- The overall number of ratings has remained steady, suggesting continued analyst interest.

- A small uptick in hold ratings may denote a hesitancy as analysts await clearer market signals.

- Strong buy ratings have remained consistent, underscoring a general positive outlook.

Percentage Trends

Recent months have shown a slight yet notable shift in analyst sentiment. The proportion of buy recommendations has maintained which reinforces confidence in Allstate's market performance. Yet, hold ratings have experienced a relative increase, which may suggest a conservative approach amid uncertain market conditions.

- Strong Buy: Consistent at approximately 30%

- Buy: Steady at about 40%

- Hold: Small increase observed, currently at 10%

- Sell and Strong Sell ratings remain minimal.

Latest Analyst Recommendations

In recent weeks, analyst recommendations for Allstate have predominantly maintained their previous ratings. This suggests a stable outlook with little divergence in opinion.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-05-07 | Outperform | Outperform | Keefe, Bruyette & Woods |

| 2025-05-06 | Overweight | Overweight | Morgan Stanley |

| 2025-05-06 | Equal Weight | Equal Weight | Wells Fargo |

| 2025-05-05 | Strong Buy | Strong Buy | Raymond James |

| 2025-05-01 | Outperform | Outperform | Evercore ISI Group |

Analyst Recommendations with Change of Opinion

Over the past year, there have been instances where analysts adjusted their ratings for Allstate, reflecting changes in market sentiment or internal analyses.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2024-08-12 | Equal Weight | Underweight | Wells Fargo |

| 2024-07-18 | Outperform | Market Perform | BMO Capital |

| 2024-03-28 | Buy | Hold | HSBC |

| 2024-01-09 | Buy | Hold | Jefferies |

| 2024-01-04 | Overweight | Equal Weight | Morgan Stanley |

Interpretation

The consistency in buy ratings indicates ongoing confidence in Allstate's market strategy and financial health. However, the slight increase in hold ratings might suggest a cautionary stance as analysts evaluate potential market shifts or internal company factors. Despite this, the abundance of strong buy and buy ratings points to a continued trust in Allstate's ability to perform. The lack of significant sell recommendations reinforces a solid standing, although future market changes could alter this sentiment.

Conclusion

Allstate continues to receive positive evaluations, with strong buy and buy ratings highlighting its potential for growth and sustained performance. While a slight increase in hold positions suggests a cautious sentiment, overall confidence remains robust. Given the data, Allstate appears prepared to capitalize on future opportunities, though analysts will likely keep a close watch on market dynamics. For investors, this underscores both the opportunities for gains and the importance of remaining informed about potential risks. As market conditions evolve, the sentiment from analysts will be crucial in guiding investment decisions.