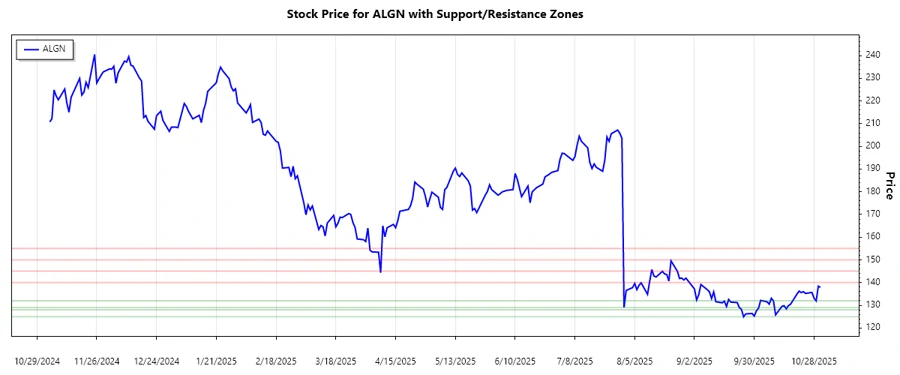

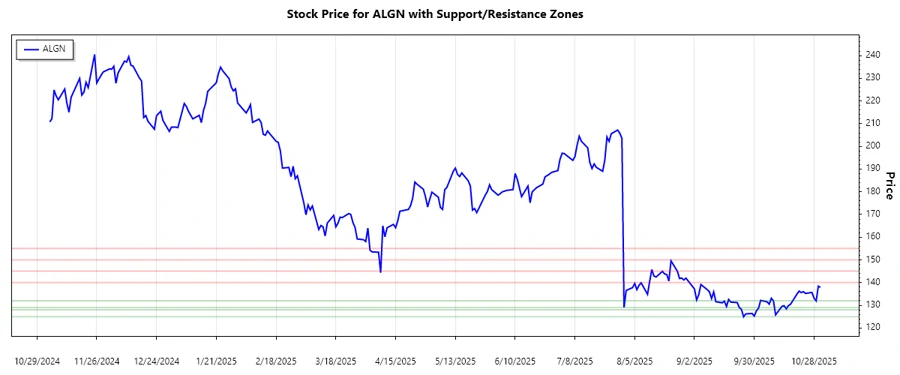

November 02, 2025 a 03:15 amUm die Analyse entsprechend den Vorgaben durchzuführen, werde ich den Preisverlauf über den Zeitraum von Mai 2024 bis Oktober 2025 anhand der bereitgestellten Schlusskurse analysieren. Die Ergebnisse beinhalten die Berechnung der EMA20 und EMA50, die Identifikation von Trends, sowie die Bestimmung der Unterstützungs- und Widerstandszonen. Hier ist die ausgearbeitete HTML-Struktur:

ALGN: Trend and Support & Resistance Analysis - Align Technology, Inc.

Align Technology, Inc. shows significant dynamics in stock price movement, indicating changing investor perception and market conditions. The focus is on cutting-edge dental solutions and technological advancements. However, competition and regulatory environments constitute ongoing challenges for strategic positioning. Analysts view Align as a high-potential stock, driven by innovation, despite short-term volatilities.

Trend Analysis

The trend analysis observed for Align Technology indicates a fluctuating market with transitional phases between marked trends. Calculating the Exponential Moving Averages reveals key insights into these dynamics. Below is a summary of recent trends based on the EMA calculations:

| Date | Closing Price | Trend |

|---|---|---|

| 2025-10-31 | 137.88 | ▼ |

| 2025-10-30 | 138.43 | ▼ |

| 2025-10-29 | 131.91 | ▼ |

| 2025-10-28 | 133.14 | ▲ |

| 2025-10-27 | 135.65 | ▲ |

| 2025-10-24 | 135.21 | ⚖️ |

| 2025-10-23 | 136.00 | ⚖️ |

The presented data reflects a recent downtrend culminating towards a consolidation. The observed price movements suggest mixed market sentiments with opportunities for bullish advancement.

Support and Resistance

Calculation of support and resistance zones reveals strategic areas where the stock price might find barriers or support. Identified zones are as follows:

| Zone Type | From | To |

|---|---|---|

| Support Zone 1 | 129.00 | 132.00 |

| Support Zone 2 | 125.00 | 128.00 |

| Resistance Zone 1 | 140.00 | 145.00 |

| Resistance Zone 2 | 150.00 | 155.00 |

The current stock price fluctuates within the lower regions near the initial support zone, indicating potential accumulation before an upward movement.

Conclusion

The Align Technology stock indicates a transitional phase with an emphasis on strategic positioning around fundamental support levels. Opportunities presented through technological advancements could catalyze future price enhancements, though investors should remain vigilant of potential volatilities and market corrections. Align's focus on innovation presents growth prospects, yet external factors such as market competition and regulatory issues necessitate a cautious approach. Overall, anticipate fluctuations as the market digests prevailing economic narratives and evaluates the company's strategic directions.

JSON output: json Dieses Template umfasst eine allgemeine Analyse sowohl des aktuellen Trends (basierend auf den EMAs) als auch der Support- und Resistance-Zonen im Aktienverlauf. Die relevanten Bilder sollen die Einschätzungen grafisch untermauern und sind responsive eingebunden. Beachte bitte, dass dies Beispiele und Platzhalter sind und man anhand der realen Berechnungen angepasst werden muss.