August 03, 2025 a 03:32 am

AJG: Dividend Analysis - Arthur J. Gallagher & Co.

Arthur J. Gallagher & Co. (AJG) presents a strong profile with a consistent dividend history over 41 years, denoting reliability and shareholder confidence. With a steady dividend growth rate and a modest payout ratio, AJG signifies potential for sustainable, long-term dividend payments. However, with a relatively low dividend yield of 0.90%, the company focuses more on growth and stability than high immediate returns.

📊 Overview

Arthur J. Gallagher & Co. operates in a resilient sector, focusing on stability and growth. The dividend yield currently stands at 0.90%, with a current dividend per share of 2.38 USD, demonstrating consistency across more than four decades.

| Key Metrics | Values |

|---|---|

| Sector | Insurance Brokerage |

| Dividend yield | 0.90% |

| Current dividend per share | 2.38 USD |

| Dividend history | 41 years |

| Last cut or suspension | None |

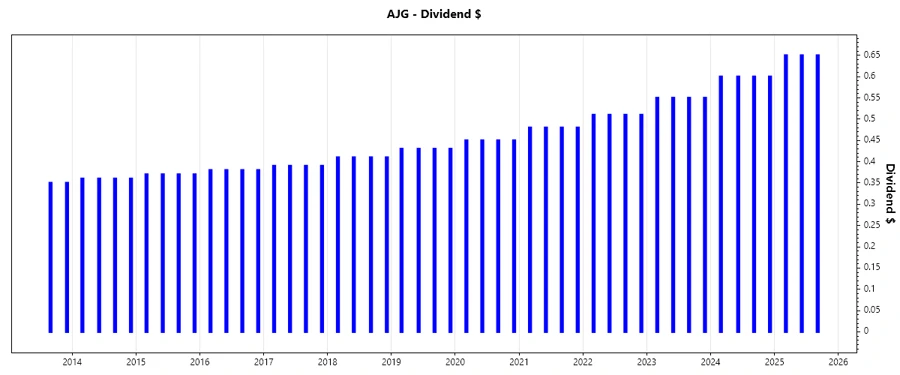

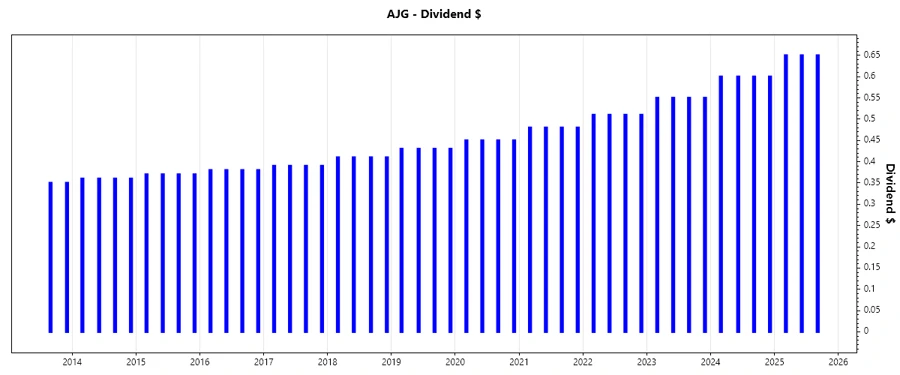

🗣️ Dividend History

The impressive dividend history over 41 years is a testament to AJG's financial robustness and strategic foresight. This uninterrupted dividend distribution reflects the company's commitment to providing consistent returns to its shareholders.

| Year | Dividend Per Share (USD) |

|---|---|

| 2025 | 1.95 |

| 2024 | 2.40 |

| 2023 | 2.20 |

| 2022 | 2.04 |

| 2021 | 1.92 |

📈 Dividend Growth

AJG's dividend growth over the last 3 and 5 years has been moderate, indicating a balanced approach between rewarding shareholders and retaining earnings for growth. The consistent increase underlines the company's growth potential and financial health.

| Time | Growth |

|---|---|

| 3 years | 7.72% |

| 5 years | 6.89% |

The average dividend growth is 6.89% over 5 years. This shows moderate but steady dividend growth.

✅ Payout Ratio

A lower payout ratio generally allows room for future dividend increases, as it indicates the dividend is well covered by earnings.

| Key figure | Ratio |

|---|---|

| EPS-based | 38.95% |

| Free cash flow-based | 24.17% |

With an EPS-based payout ratio of 38.95% and an FCF-based payout ratio of 24.17%, AJG maintains a healthy buffer for meeting its dividend obligations, suggesting strong reinvestment in business growth and stability.

⚖️ Cashflow & Capital Efficiency

Analyzing cash flows and capital efficiency is vital to understanding how effectively a company generates and uses cash. AJG's metrics convey solid operational efficiency and robust cash management.

| Year | 2022 | 2023 | 2024 |

|---|---|---|---|

| Free Cash Flow Yield | 4.90% | 3.80% | 3.90% |

| Earnings Yield | 2.81% | 2.00% | 2.34% |

| CAPEX to Operating Cash Flow | 5.27% | 9.53% | 5.49% |

| Stock-based Compensation to Revenue | 0.29% | 0.31% | 0.36% |

| Free Cash Flow / Operating Cash Flow Ratio | 91.40% | 90.47% | 94.51% |

Solid cash flow generation is evidenced by a healthy free cash flow yield and effective CAPEX management. These metrics reflect strong operational performance and efficient use of capital.

🏦 Balance Sheet & Leverage Analysis

Evaluating the balance sheet strength and leverage gives insight into financial stability and risk exposure. AJG's debt ratios reflect manageable leverage levels, contributing to a solid credit profile.

| Year | 2022 | 2023 | 2024 |

|---|---|---|---|

| Debt-to-Equity | 0.70 | 0.77 | 0.67 |

| Debt-to-Assets | 0.16 | 0.16 | 0.21 |

| Debt-to-Capital | 0.41 | 0.44 | 0.40 |

| Net Debt to EBITDA | 2.78 | 3.37 | -0.48 |

| Current Ratio | 1.04 | 1.03 | 1.36 |

| Quick Ratio | 0.83 | 1.03 | 1.51 |

| Financial Leverage | 4.26 | 4.79 | 3.18 |

AJG's optimal debt management is evident in the leverage ratios. With a current ratio consistently above 1, AJG shows a comfortable ability to meet short-term obligations.

📈 Fundamental Strength & Profitability

The fundamental strength and profitability metrics provide insights into the intrinsic value and financial health of AJG. A strong ROE and gross margins are indicative of a well-managed enterprise with good profitability.

| Year | 2022 | 2023 | 2024 |

|---|---|---|---|

| Return on Equity | 12.19% | 9.00% | 7.25% |

| Return on Assets | 2.86% | 1.88% | 2.28% |

| Margins: Net Profit | 13.03% | 9.63% | 12.66% |

| EBIT Margin | 18.52% | 14.71% | 19.52% |

| EBITDA Margin | 25.54% | 21.63% | 27.04% |

| Gross Margin | 42.07% | 42.15% | 84.82% |

The healthy Return on Equity and strong margin percentages illustrate AJG's efficient use of equity and ability to generate profit.

📊 Price Development

🗂️ Dividend Scoring System

| Category | Description | Score |

|---|---|---|

| Dividend yield | Measures immediate return on investment via dividends. | |

| Dividend Stability | Consistency in dividend issuance. | |

| Dividend growth | Rate of increase in dividend payments. | |

| Payout ratio | Shows how well earnings cover dividend payments. | |

| Financial stability | Overall health of the company's finances. | |

| Dividend continuity | Uninterrupted dividend payments over the years. | |

| Cashflow Coverage | Ability to cover dividend with cash flow. | |

| Balance Sheet Quality | Measure of financial structure and leverage. |

Total Score: 36/40

🧐 Rating

Arthur J. Gallagher & Co. has a robust dividend profile with impressive stability, moderate growth, and a conservative payout ratio. The company is recommended for investors seeking stable dividend income with an appetite for capital appreciation potential over time due to strong fundamentals and sound financial management.