November 05, 2025 a 03:15 am

AIZ: Trend and Support & Resistance Analysis - Assurant, Inc.

Assurant, Inc. (AIZ) has shown notable movements in its stock price over the past months. Recently, there has been a mix of trends visible in the stock, indicating investor reactions to the company's diverse offerings in the Global Lifestyle and Global Housing segments. The stock's current positioning could present opportunities for both short-term traders and long-term investors, depending on the observed support and resistance zones.

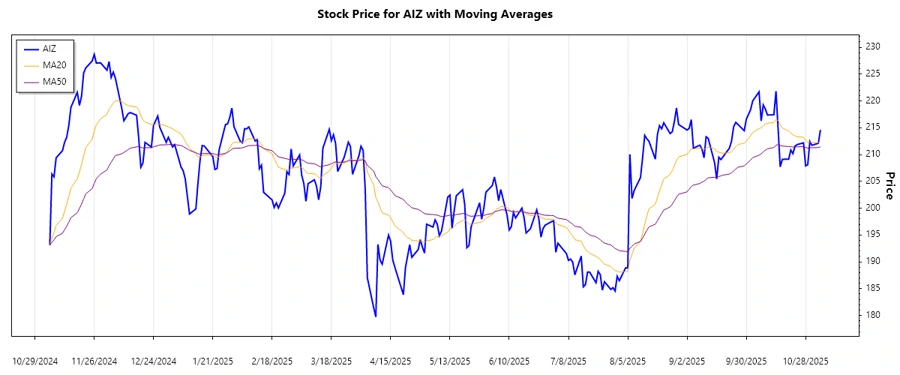

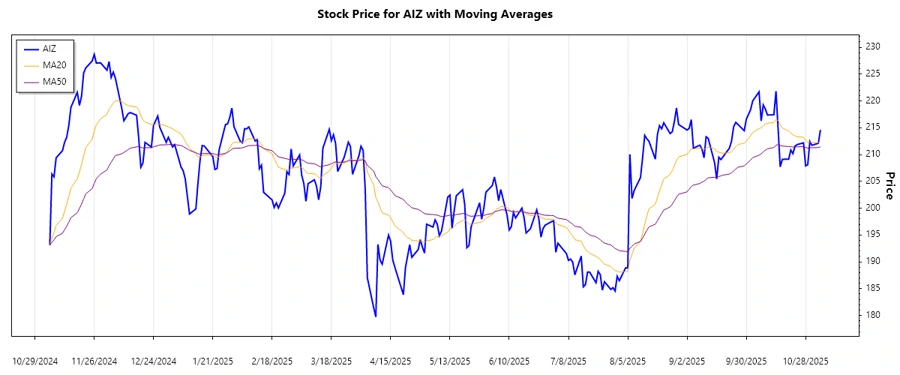

Trend Analysis

The recent data analysis of Assurant, Inc.'s stock prices reveals fluctuations that can be interpreted by examining the exponential moving averages (EMAs). The recent EMA calculations showcase a short-term trend:

| Date | Close Price | Trend |

|---|---|---|

| 2025-11-04 | $214.60 | ▲ |

| 2025-11-03 | $212.11 | ▼ |

| 2025-10-31 | $211.72 | ▼ |

| 2025-10-30 | $212.43 | ▲ |

| 2025-10-29 | $208.11 | ▼ |

| 2025-10-28 | $207.89 | ▼ |

| 2025-10-27 | $212.19 | ▲ |

Current trends indicate a downward pressure recently. Investors must consider short-term market sentiments before making decisions. The analysis suggests increased market volatility.

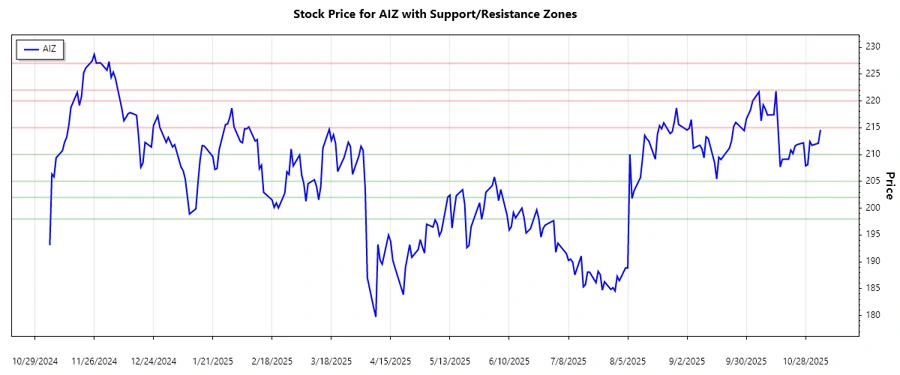

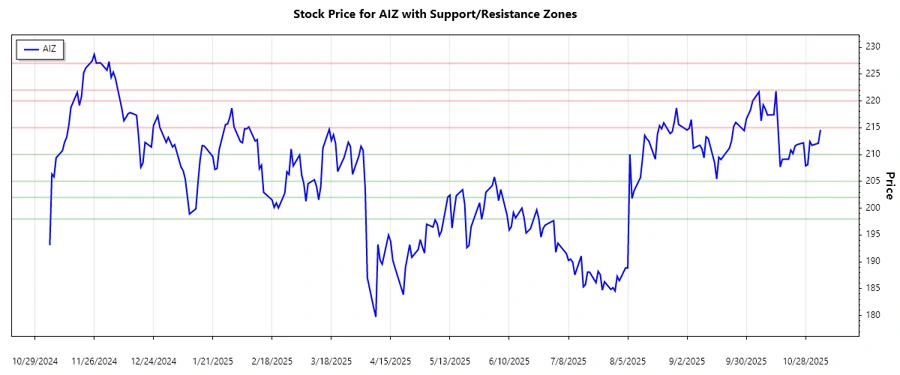

Support and Resistance

Based on the daily prices, notable support and resistance levels for Assurant, Inc. have been identified:

| Support Zone | Resistance Zone |

|---|---|

| $205.00 - $210.00 | $215.00 - $220.00 |

| $198.00 - $202.00 | $222.00 - $227.00 |

Currently, the stock price is within the first support zone, indicating potential stability in this range. Traders should be cautious of any sustained movements beyond these areas. The identification of these zones is crucial for predicting potential breakout points.

Conclusion

In summary, Assurant, Inc. is experiencing fluctuations around key technical levels. The presence of support and resistance zones suggests potential trading opportunities. While the short-term trend indicates a slight downward momentum, the presence of strong support levels may indicate a potential rebound. Considering the diversified business operations of Assurant, their stock could provide intriguing prospects amidst market volatility. Traders should remain vigilant for movements beyond identified technical levels, as they may provide signals for entry or exit.