September 15, 2025 a 08:15 am

AES: Trend and Support & Resistance Analysis - The AES Corporation

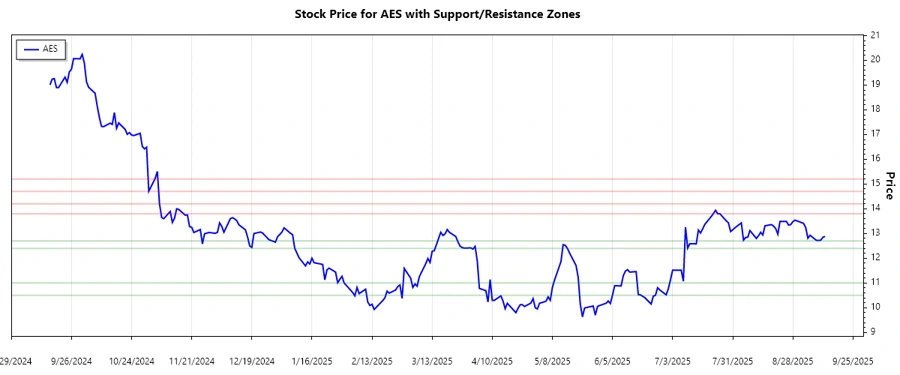

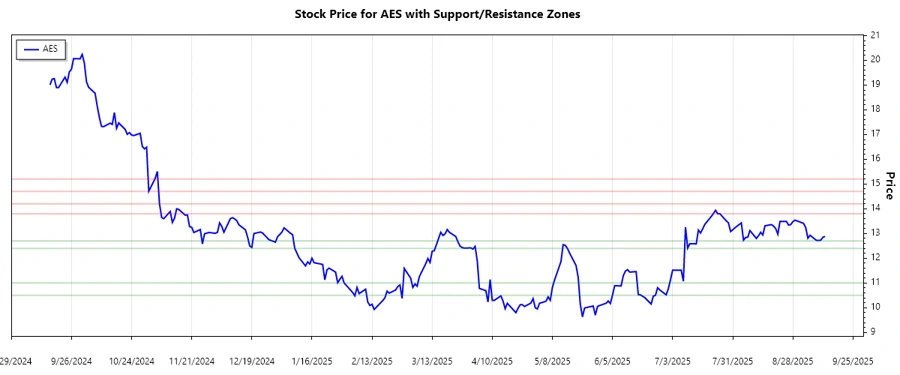

The AES Corporation, as a diversified power generation and utility company, leverages various energy sources to maintain operational resilience. Based on the latest technical analysis, the stock has shown fluctuating trends influenced by macroeconomic conditions affecting the energy sector. Understanding the support and resistance levels can offer key insights into potential future movements for investors.

Trend Analysis

The recent historical data for AES suggests a notable trend shift over the past months. Calculating the exponential moving averages (EMAs), a transition phase between trends is observable. The computed EMAs help to substantiate the price action analysis:

| Date | Close | Trend |

|---|---|---|

| 2025-09-12 | 12.88 | ⚖️ Sideways |

| 2025-09-11 | 12.85 | ⚖️ Sideways |

| 2025-09-10 | 12.73 | ⚖️ Sideways |

| 2025-09-09 | 12.72 | ⚖️ Sideways |

| 2025-09-08 | 12.72 | ⚖️ Sideways |

| 2025-09-05 | 12.93 | ⚖️ Sideways |

| 2025-09-04 | 12.81 | ⚖️ Sideways |

The use of EMAs reveals a consolidation phase where the market lacks a decisive direction, indicating a potential zone of accumulation or distribution.

Support and Resistance

The analysis on support and resistance levels suggests that AES is localized within specific price boundaries. Calculations indicate:

| Zone Type | Price Range |

|---|---|

| Support Zone 1 | 10.50 - 11.00 ▲ |

| Support Zone 2 | 12.40 - 12.70 ▲ |

| Resistance Zone 1 | 13.80 - 14.20 ▼ |

| Resistance Zone 2 | 14.70 - 15.20 ▼ |

Given current pricing, the stock appears to be within the first support zone, suggesting potential buying interest at these levels.

The current pricing context within the support levels points to a rebounding opportunity, contingent upon broader market forces and sector-specific news.

Conclusion

The AES Corporation demonstrates limited risk with potential upside momentum within current technical boundaries. The transitional trend, within well-observed support and resistance zones, suggests that investors should recognize the strategic implications of holding or entering positions within the energy sector. The apparent sideways market motion indicates volatility that could see AES pivot swiftly in response to macro developments or sector-specific changes, offering tactical entry points for risk-appetite investors.