October 02, 2025 a 03:43 pm

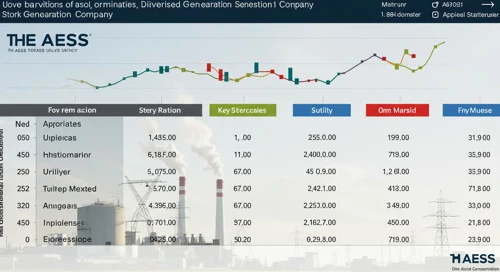

AES: Fundamental Ratio Analysis - The AES Corporation

The AES Corporation, a diversified power generation and utility company, has shown consistent operational growth. With a strong portfolio in various geographies, it utilizes a wide range of fuels and technologies to meet energy demands effectively. Its ability to adapt to renewable energy sources marks its commitment to sustainable development.

Fundamental Rating

The fundamental rating of AES indicates a stable operational performance with room for improvement in certain areas. Below are the evaluation categories and their respective scores.

| Category | Score | Visualization |

|---|---|---|

| Discounted Cash Flow | 4 | |

| Return On Equity | 5 | |

| Return On Assets | 4 | |

| Debt To Equity | 1 | |

| Price To Earnings | 4 | |

| Price To Book | 2 |

Historical Rating

Historical data shows the performance of AES over time, indicating its trends in scoring metrics.

| Date | Overall | DCF | ROE | ROA | D/E | P/E | P/B |

|---|---|---|---|---|---|---|---|

| 2025-10-01 | 4 | 4 | 5 | 4 | 1 | 4 | 2 |

| Previous | 0 | 4 | 5 | 4 | 1 | 4 | 2 |

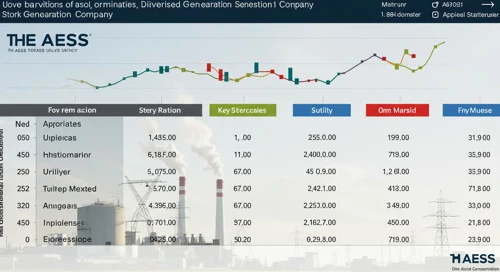

Analysts' Price Targets

Analysts provide a positive outlook for AES with a consensus rating of 'Buy'. The price targets are outlined below.

| High | Low | Median | Consensus |

|---|---|---|---|

| $32 | $7 | $24 | $22.3 |

Analysts' Sentiment

The analyst sentiment for AES is largely favorable, with 'Buy' recommendations being predominant.

| Recommendation | Count | Visualization |

|---|---|---|

| Strong Buy | 0 | |

| Buy | 13 | |

| Hold | 6 | |

| Sell | 2 | |

| Strong Sell | 0 |

Conclusion

AES Corporation demonstrates a strong market presence with diversified energy solutions, underpinned by a solid portfolio across numerous regions. The company's adoption of renewable energy sources positions it well for future growth. However, attention should be given to areas like debt management. Overall, the company's prospects are promising with positive analyst sentiment and stable performance ratings.