October 28, 2025 a 05:01 pm

ADSK: Analysts Ratings - Autodesk, Inc.

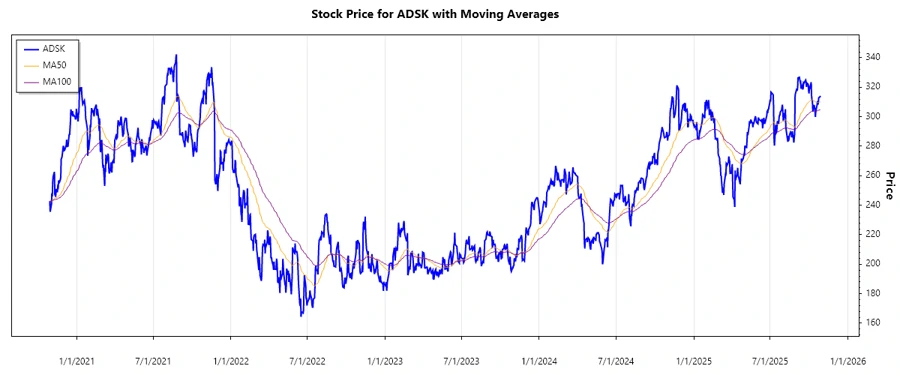

Autodesk, Inc. remains a key player in the 3D design, engineering, and entertainment software sectors. With its diverse suite of products, the company caters to a broad audience spanning civil engineering to the media and entertainment industries. Given the sustained interest and consistent performance, Autodesk's stock continues to be a subject of interest among analysts. Let's dive into the recent analyst ratings and market sentiment to understand the trends and shifts impacting Autodesk, Inc.

Historical Stock Grades

The latest data from October 2025 shows a consistent analyst confidence in Autodesk, Inc. with no Sell or Strong Sell ratings. The positive outlook is primarily supported by a combination of Strong Buy and Buy ratings.

| Recommendation | Count | Score |

|---|---|---|

| Strong Buy | 5 | |

| Buy | 20 | |

| Hold | 7 | |

| Sell | 0 | |

| Strong Sell | 0 |

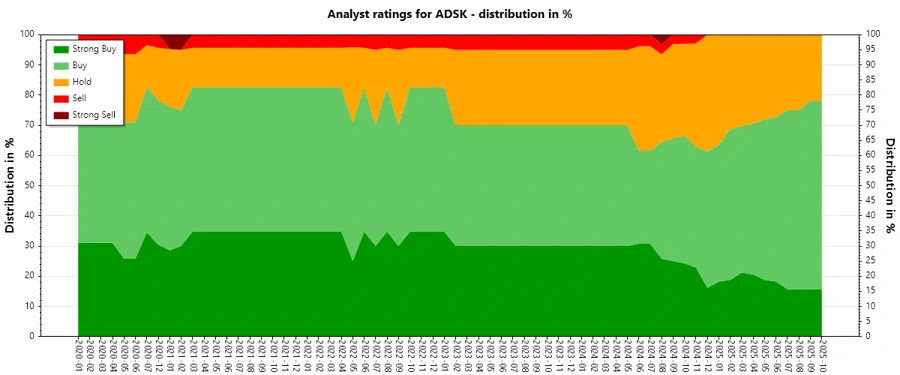

Sentiment Development

The sentiment around Autodesk, Inc. remains generally optimistic, with a steady number of Buy ratings. Over recent months, the distribution of ratings indicated a balanced investor confidence. Detailed observation reveals:

- The total number of ratings has remained consistent, demonstrating stability in analyst opinions.

- No significant changes in Sell or Strong Sell categories, indicating perceived stability in Autodesk's market standing.

- Fluctuations in Strong Buy and Hold categories suggest minor adjustments in investor sentiment.

Percentage Trends

Analysis of percentage trends exposes subtle shifts in analyst sentiment. The data reflects minor fluctuations between categories but an overall steadfast confidence in Autodesk's potential:

- Steady decrease in Strong Buy from early 2025, signaling a more cautious yet positive outlook.

- Slight increase in Hold ratings over the months, suggesting increased conservatism amongst some analysts.

- No significant shift towards negative ratings, maintaining Autodesk within favorable analyst reviews.

Latest Analyst Recommendations

Recent recommendations for Autodesk continue to reflect a predominance of positive sentiment. Below is a snapshot of the latest analyst activity:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-10-06 | Outperform | Outperform | RBC Capital |

| 2025-10-01 | Buy | Hold | HSBC |

| 2025-09-02 | Overweight | Overweight | Morgan Stanley |

| 2025-09-02 | Buy | Buy | Citigroup |

| 2025-08-29 | Overweight | Overweight | Piper Sandler |

Analyst Recommendations with Change of Opinion

The following table highlights notable changes in analyst recommendations, showcasing shifts in sentiment towards Autodesk, Inc.:

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-10-01 | Buy | Hold | HSBC |

| 2025-07-07 | Buy | Neutral | DA Davidson |

| 2025-06-27 | Buy | Hold | Berenberg |

| 2025-01-28 | Outperform | Neutral | Mizuho |

| 2025-01-08 | Overweight | Neutral | Piper Sandler |

Interpretation

Analyzing the data on Autodesk, Inc., the market sentiment appears generally positive with analysts favoring Buy and Overweight ratings. While the number of Strong Buy ratings has diminished slightly, the majority of recommendations continue to advocate for investment or increased exposure. There is no significant indication of uncertainty or hesitation, which suggests confidence in the company's current trajectory and future potential. The stability in ratings over recent months further underscores a consistent faith in Autodesk's business strategy and market position.

Conclusion

In conclusion, Autodesk, Inc. presents a strong case for investment with analysts showing robust confidence through stable Buy and Strong Buy recommendations. Despite slight fluctuations, the overarching market sentiment over the past year indicates a conducive environment for growth and stability. Investors should consider Autodesk's potential for sustained performance balanced with mindful observation of market conditions that could influence future sentiment.