June 03, 2025 a 01:00 pm

ACGL: Analysts Ratings - Arch Capital Group Ltd.

Arch Capital Group Ltd. is experiencing a stable phase in its stock performance, as indicated by current analyst ratings. The company's diversified product offerings in the insurance, reinsurance, and mortgage insurance sectors provide a robust defensive portfolio, even as market volatility persists. Current analysis reveals a propensity for maintaining positive albeit cautious stances amidst market instincts. Investors could interpret these ratings as a signal of Arch Capital's resilience and potential for robust returns.

Historical Stock Grades

| Rating | Count | Score Bar |

|---|---|---|

| Strong Buy | 4 | |

| Buy | 6 | |

| Hold | 4 | |

| Sell | 0 | |

| Strong Sell | 0 |

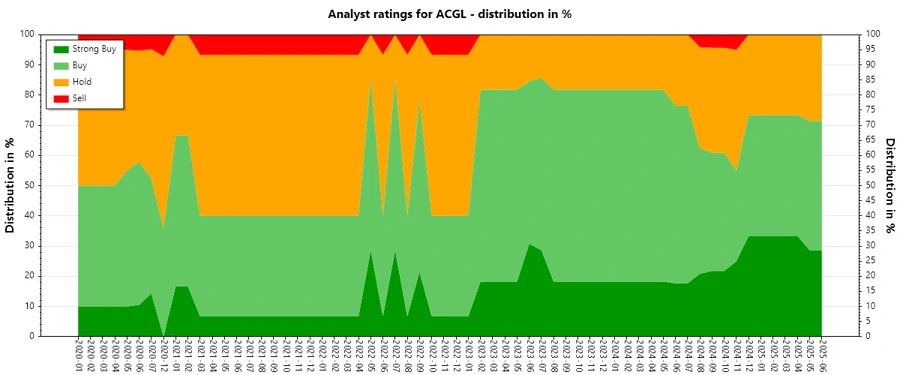

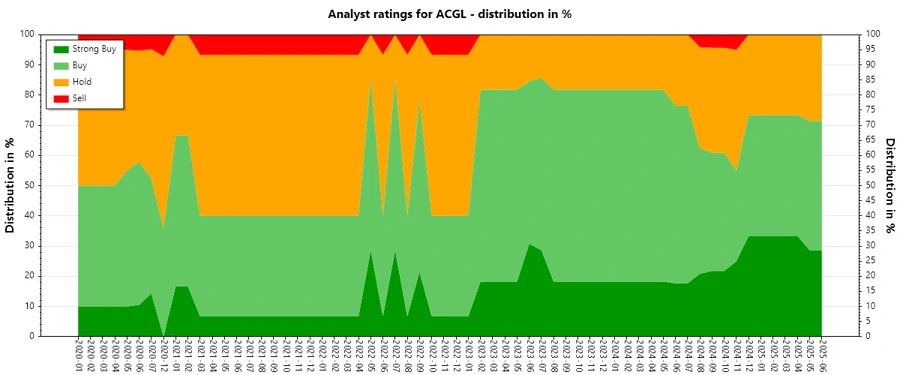

Sentiment Development

The sentiment towards Arch Capital appears consistent with no abrupt changes in the distribution of ratings. Over recent months, the number of "Strong Buy" ratings has been moderately stable with slight fluctuations, complemented by a noteworthy presence of "Hold" recommendations.

- Stable count of ratings with minor monthly fluctuations.

- Small decline in "Strong Buy" ratings in the second half of 2024.

- "Hold" recommendations increased slightly, indicating a cautious outlook.

Percentage Trends

The distribution of analyst ratings has seen several subtle shifts over the last year. Sharp increases in "Hold" ratings correspond with decreasing trends in "Strong Buy," signaling a more conservative view on part of the analysts.

- Gradual decrease in "Strong Buy" recommendations from mid-2024.

- "Buy" recommendations remain largely consistent.

- Percetual increase in "Hold" ratings, indicating a shift towards caution.

- No significant changes in "Sell" or "Strong Sell" categories.

In the last 6 months, there has been a perceptual shift towards "Hold" and away from "Strong Buy".

Latest Analyst Recommendations

Recent analyst recommendations suggest a relatively stable sentiment with a continued confidence in Arch Capital Group. Ratings generally reflect maintained positions rather than drastic upgrades or downgrades.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2025-05-19 | Overweight | Overweight | Morgan Stanley |

| 2025-05-06 | Outperform | Outperform | Keefe, Bruyette & Woods |

| 2025-05-01 | Overweight | Overweight | Wells Fargo |

| 2025-04-30 | Market Outperform | Market Outperform | JMP Securities |

| 2025-04-11 | Buy | Buy | Jefferies |

Analyst Recommendations with Change of Opinion

Throughout recent years, there have been minimal recommendation changes, with the majority of adjustments being upgrades. This suggests a predominantly positive long-term outlook from analysts.

| Date | New Recommendation | Last Recommendation | Publisher |

|---|---|---|---|

| 2021-01-19 | Market Outperform | Market Perform | JMP Securities |

| 2021-01-18 | Market Outperform | Market Perform | JMP Securities |

| 2020-01-06 | Overweight | Equal Weight | Wells Fargo |

| 2020-01-05 | Overweight | Equal Weight | Wells Fargo |

| 2019-11-12 | Neutral | Overweight | JP Morgan |

Interpretation

The prevailing sentiment from analysts reflects a stable yet cautiously optimistic outlook for Arch Capital Group Ltd. The laboring integrity amongst rating scales may be indicative of either a lack of substantial developments or consistent performance from the company. However, the presence of any upgrades portrays moderate confidence in its future potential by market experts.

Investor confidence appears robust with minimal risk highlighted in the latest ratings. Meanwhile, a perceptible transition towards more "Hold" recommendations may suggest a tempered bullish sentiment as caution permeates market thinking.

Conclusion

The recent analysis hints towards moderate confidence in Arch Capital’s potential, hedged by a sense of market prudence reflected in increased “Hold” ratings. The static trend in most categories underscores either a consistent company trajectory or market readiness to adapt to changing conditions. As Arch Capital navigates economic uncertainties, stakeholders might benefit from current recommendations by maintaining existing positions and observing longer-term indicators.