October 18, 2025 a 01:15 pm

ABT: Trend and Support & Resistance Analysis - Abbott Laboratories

Abbott Laboratories, a leader in the healthcare industry, has shown resilience within its market segments, offering diverse products such as pharmaceuticals, diagnostics, nutritionals, and medical devices. The stock has seen significant interest due to Abbott's ongoing innovation and market penetration strategies. Recent analysis of stock trends and support/resistance levels provides valuable insights for investors evaluating the potential for future gains or market corrections.

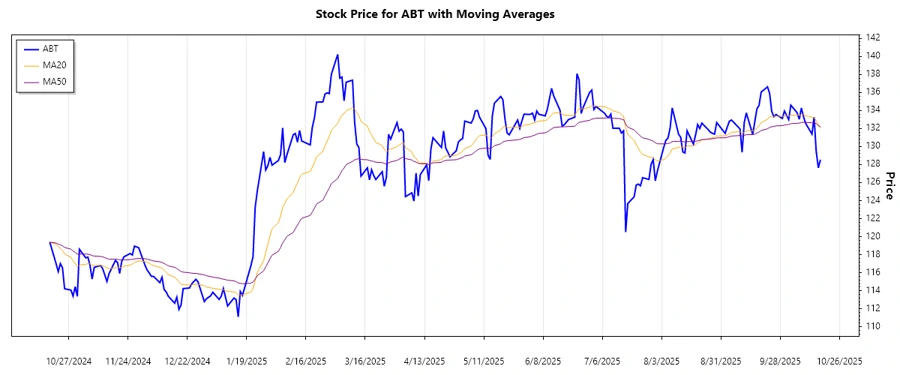

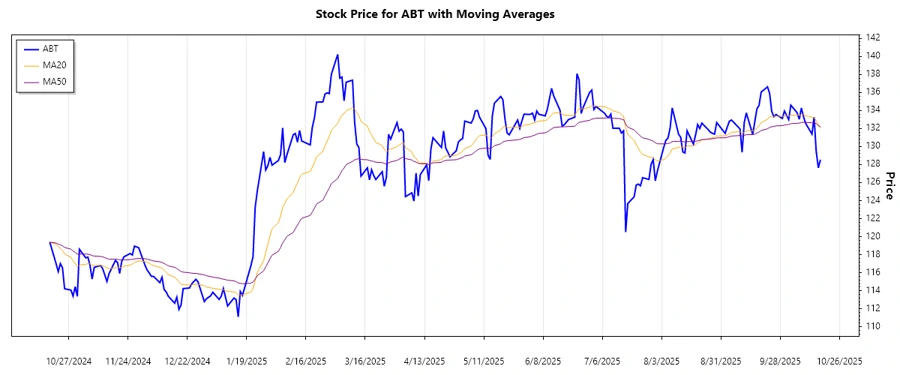

Trend Analysis

For the analysis conducted over the recent trade data, the exponential moving averages (EMA) were calculated using closing prices to deduce the market trend of Abbott Laboratories. The EMA20 and EMA50 have been compared for drawing insights regarding the current market stance.

| Date | Close Price | Trend |

|---|---|---|

| 2025-10-17 | $128.54 | ▼ |

| 2025-10-16 | $127.63 | ▼ |

| 2025-10-15 | $129.45 | ▲ |

| 2025-10-14 | $133.27 | ▲ |

| 2025-10-13 | $131.38 | ▲ |

| 2025-10-10 | $132.57 | ▲ |

| 2025-10-09 | $133.31 | ▲ |

The recent short-term analysis indicates a slight downward trend, however, the presence of an upward pattern in the recent weeks suggests potential stabilization. The EMA20 being below EMA50 confirms a dominant bearish tendency.

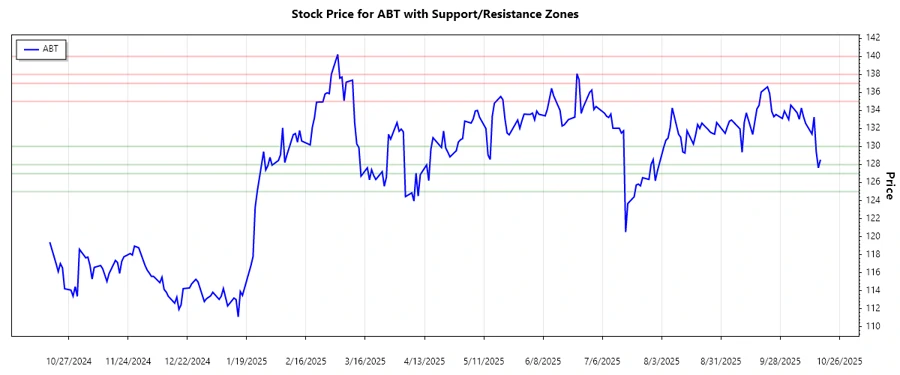

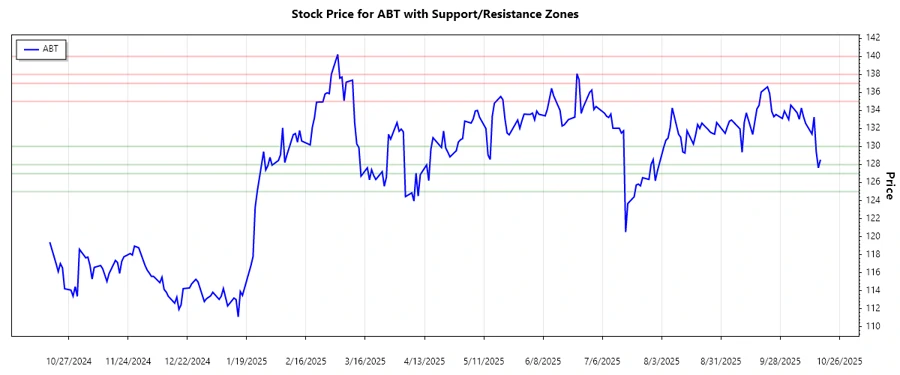

Support and Resistance

Through the evaluation of price fluctuations, Support and Resistance zones provide snapshot points where trading activities could evolve. Identifying these zones assists in potential entry and exit decisions for the investors.

| Zone Type | Start | End |

|---|---|---|

| Support 1 | $128.00 | $130.00 |

| Support 2 | $125.00 | $127.00 |

| Resistance 1 | $135.00 | $137.00 |

| Resistance 2 | $138.00 | $140.00 |

Currently, the stock price is within the higher support zone, indicating potential rebound or further downward movement. Investors should observe for a breakthrough in the current range.

Conclusion

Abbott Laboratories is positioned in an active segment of healthcare, offering robust growth potential notwithstanding current market challenges. The trend analysis suggests a bearish sentiment, yet the stock's positioning in crucial support territories indicates that a sustained rally could reverse recent declines. Investors should consider both market-driven triggers and internal innovations as key drivers of future value. Continual monitoring of trading patterns and news can leverage potential portfolio growth with risk mitigated through disciplined entry points.