February 11, 2026 a 11:44 am

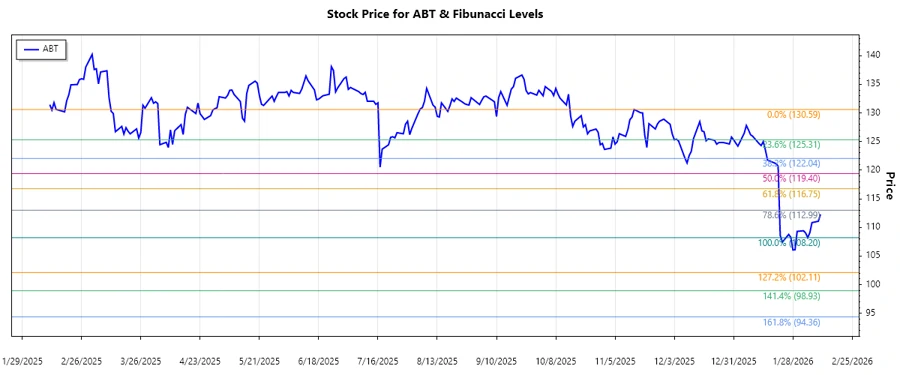

ABT: Fibunacci Analysis - Abbott Laboratories

Abbott Laboratories' stock (ABT) exhibits a recent dominant downtrend from late 2025 into early 2026. As a leading healthcare products company, Abbott is well-positioned across various segments, potentially buffering against broader market declines. Investors should focus on technical signals alongside the company's diversified healthcare offerings to gauge potential market rebounds or further declines.

Fibonacci Analysis

| Detail | Information |

|---|---|

| Start Date | 2025-11-14 |

| End Date | 2026-02-10 |

| High Point (Price & Date) | $130.59 on 2025-11-14 |

| Low Point (Price & Date) | $108.2 on 2026-02-04 |

| Fibonacci 0.236 Level | $113.58 |

| Fibonacci 0.382 Level | $117.64 |

| Fibonacci 0.5 Level | $119.40 |

| Fibonacci 0.618 Level | $121.16 |

| Fibonacci 0.786 Level | $124.09 |

| Current Price | $112.28 |

| Retracement Zone | below 0.236 |

| Technical Interpretation | The current price is below the 0.236 Fibonacci retracement level, indicating potential further decline before finding a support area or reversal. |

Conclusion

Abbott Laboratories is currently experiencing a significant downtrend, and technical indicators suggest potential further declines unless a strong support level is found. As a robust company with diversified segments, Abbott may overcome short-term bearish trends with its consistent revenue streams from healthcare products. However, investors should remain cautious, watching for any signs of reversal or significant support regions indicated by Fibonacci levels. The stock's recovery depends on both broader market conditions and the company's performance in its strategic segments.