August 29, 2025 a 09:04 am

AAPL: Trend and Support & Resistance Analysis - Apple Inc.

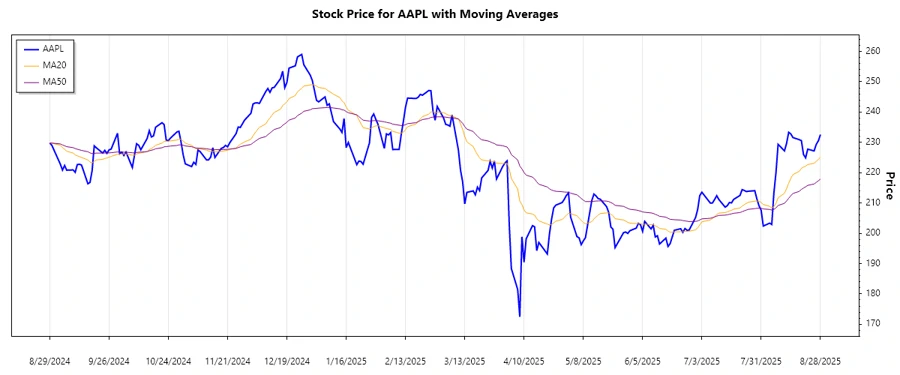

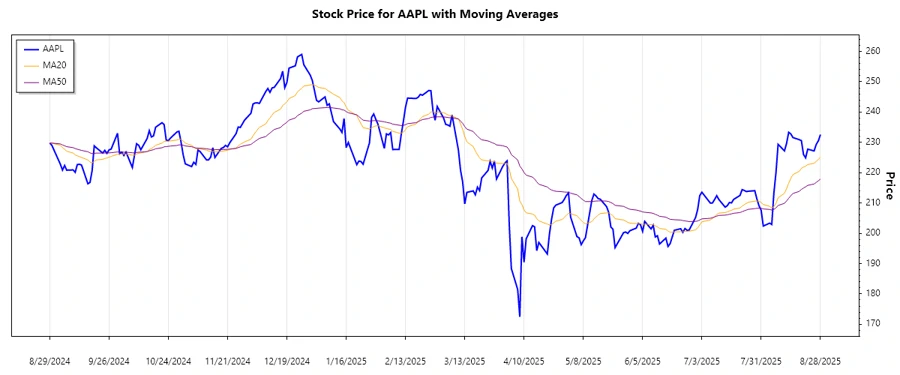

The recent analysis on Apple Inc. (AAPL), which designs and sells innovative products like iPhones and Macs globally, reveals a multidimensional trend. Following fluctuations influenced by product launches and market conditions, the stock is showing mixed trends influenced by both short-term product announcements and longer-term market strategies. Understanding these patterns offers opportunities for bullish observers while highlighting caution for potential downturns for risk-averse investors.

Trend Analysis

The trend analysis focuses on the performance of Apple Inc. over the past months using EMA strategies. Analysis of the closing prices indicates a general upward trajectory in the latest data points. Calculated EMAs suggest recent positive sentiment around Apple Inc.'s offerings in the market.

| Date | Closing Price | Trend |

|---|---|---|

| 2025-08-28 | 232.56 | ▲ Uptrend |

| 2025-08-27 | 230.49 | ▲ Uptrend |

| 2025-08-26 | 229.31 | ▲ Uptrend |

| 2025-08-25 | 227.16 | ▲ Uptrend |

| 2025-08-22 | 227.76 | ▲ Uptrend |

| 2025-08-21 | 224.9 | ▲ Uptrend |

| 2025-08-20 | 226.01 | ▲ Uptrend |

The dominance of an uptrend is evident, highlighted by the EMA's longer-term movement above baseline averages, indicating positive investor sentiment.

Support- and Resistance

Analyzing support and resistance zones provides deeper insight into market behavior. Recent price actions highlight important zones that can potentially halt price movements or continue trends.

| Zone | Range |

|---|---|

| Support Zone 1 | 220.00 - 225.00 |

| Support Zone 2 | 210.00 - 215.00 |

| Resistance Zone 1 | 230.00 - 235.00 |

| Resistance Zone 2 | 240.00 - 245.00 |

The stock is currently in the resistance range of 230.00 - 235.00, suggesting limited upward movements unless significant market catalysts are introduced.

Conclusion

In conclusion, AAPL stock is positioned within a potential upward momentum, buffered by supportive economic fundamentals and tech innovation. However, resistance zones present challenges that could decelerate upward trajectories. Key onlookers should monitor global trends and device launch impacts. A bullish yet cautious outlook fits, balancing between stark technological advancements and macroeconomic pressures.